Premier Cable Manufacturer in China

optical cable corporation (occ)

by:AAA

2021-01-13

Telephone Number of 2017, including area code)

The month (b)

Securities registered under article 12 (g)

Behavior: no eyes☐No. ☒Section 13 or 15 (d)

Securities Trading Act of 1934.

Yes. ☐No. ☒All reports requested in Section 13 or 15 have been submitted (d)

Securities Trading Act of 1934 within the first 12 months (

Or a short period of time required for the registrant to submit such reports), and (2)

This filing requirement has been bound for the last 90 days. (1)Yes☒No☐(2)

Yes. ☒No. ☐Regulation 405-

12 months before T (

Or in such a short time that the registrant is required to submit and publish these documents).

Yes. ☒No. ☐S-regulation 405K (Section 229.

This Chapter 405)

As the registrant is aware, it is not included here and will not be included in the final proxy or information statement referenced in Part 3 of this form --

K or any amendments to this form 10K.

☐☐Speed up Filer☐Non

Speed up Filer☐Small Reporting Company☒☐☐Yes. ☐No. ☒Non-held common stock with no face value

Related Companies of registrants (

Does not recognize that any of the shares are not included in the determination of such value is a related company)

As of April 30, 2017, according to the NASDAQ Global Market Report of April 30, 2017, the last working day of the company in the most recent second quarter was $13,802,066.

In December 12, 2017, the company issued 7,305,988 shares of common stock.

Annual report submitted as Annex 13.

Report on Form 10 1-

K incorporated by reference in the second part of this table 10

K report: \"Company Information\", \"Management Discussion and Analysis of financial status and results of operations\", \"notes to consolidated financial statements\", Report of Independent CPA firm.

\"In addition, part of the agency statement of the company\'s 2018 annual shareholders meeting is incorporated by reference in part 3 of this form 10.

K report: \"Election of Directors\", \"beneficial ownership of securities\", \"executive compensation\", \"remuneration of directors\", \"compliance with Section 16th (a)

Securities Trading Act of 1934, code of ethics, executive compensation, beneficial ownership of securities, information on equity compensation plans, \"certain relationships and related transactions\", \"independent registration accounting firm and Audit Committee

Approval of audits and permitted non-

Audit services for independent CPA firms. ”1. 1A. 1B. 2. 3. 4. 5.

Equity and related shareholders. 6. 7.

Discussion and Analysis of financial status and operational results. 7A. 8. 9. 9A. 9B. 110. 211. 212. 213. 214.

Fees and services. 315. 481. BUSINESS265-0690.

Optical cable company and our wholly owned subsidiary Applied Optical Systems Company(“AOS”)

And center Solutions Co. , Ltd (

\"Center solution \")

With office, manufacturing and warehouse facilities in Roanoke, Virginia, close to Asheville, North Carolina and Dallas, Texas. ®”)

Is a leading manufacturer of optical fiber and copper data communication cabling and connectivity solutions, mainly for the enterprise market and a variety of harsh environments and professional markets (the non-Operator market)

Provide an integration suite of high quality products, run as a system solution, or seamlessly integrate with products from other providers.

OCC also produces and sells products in the wireless carrier market.

Our products include designs for uses ranging from enterprise networks, data centers, residential and campus facilities to customized products for special applications and harsh environments (including military, industrial, mining, petrochemical), etc, wireless operators and broadcast applications. -

Integrate communication solutions by bundling our products into systems that serve our customers and terminals

Users with integrated cabling and connectivity solutions

Suitable for personal data communication and application needs.

®Is an international recognized pioneer in the design and production of fiber optic cables for the most demanding military applications, as well as fiber optic cables suitable for indoor and outdoor, based on the development of these basic technologies, create a wide range of products.

OCC®It is also an international recognized pioneering and innovative copper connection technology and design to meet the development of copper data communication standards in the industry.

Mainly registered with ISO 9001: 2008 and MIL-STD-

790G certified factory located in Roanoke, Virginia, mainly in ISO 9001: 2008 registered factory located near Asheville, North Carolina, producing enterprise connection products and mainly in ISO 9001: 2008 registration and MIL-STD-

790G certification facility near Dallas, Texas.

Enterprise, harsh environment, professional market and application.

We call these products our fiber optic cable products.

OCC designs, develops and manufactures fiber and copper connectivity products for the enterprise market, including a wide range of enterprise and residential applications.

We call these products our enterprise connection products.

The OCC is mainly used in military, harsh environments and other special applications to design, develop and manufacture a wide range of professional fiber optic connectors and connection solutions.

We call these products our harsh environment and professional connected products.

Provide harsh environment and professional connectivity products through AOS called optical cable company and OCC®With the efforts of our integrated OCC sales team.

Center Solutions Co. , Ltd. , a wholly owned subsidiary of the company (

\"Center solution \")

Provide cabling and connectivity solutions for the data center market.

Centric solution\'s business is located at the OCC factory near Dallas, Texas.

®South River®Three blades in Nanhe™Advanced Modular Products™SMP Data Communication™Applied Optical System™Focus on solution™And the relevant logo is the trademark of the optical cable company.

®Is a leading manufacturer of optical fiber and copper data communication cabling and connectivity solutions, mainly for the enterprise market and a variety of harsh environments and professional markets (the non-Operator market)

Provide an integrated set of high-quality, guaranteed products that operate as a system solution or seamlessly integrate with products from other providers.

OCC also produces and sells a large number of products in the wireless carrier market.

OCC\'s products include designs for a variety of uses, from enterprise networks, data centers, residential and campus facilities, to customized products for harsh environments and special applications, including military, industrial, mining wireless operators and broadcast applications.

In the past two years, the OCC has obtained or received a license notice for 23 fiber and copper connections and patents for innovative design of fiber optic cables.

Mainly for the enterprise market and various harsh environments and professional markets (the non-Operator market)

Including enterprise networks, data centers, residential and campus facilities, as well as the demand for harsh environments and professional markets such as military, industrial, mining, petrochemical and broadcasting applications, to a lesser extent.

OCC also produces and sells a large number of fiber optic cables and hybrid cables (

Fiber and copper)

Products in the wireless operator market.

Our patents.

Buffer fiber unit cable with high fiber-

Calculated and rugged in a compact and lightweight design.

We believe we provide the most comprehensive

Provide buffer optical cable products for our market. (

Fiber and copper)

And cables with special fibers.

In some installations, we can provide additional protection for fiber optic cables.

We offer cables for underground or overhead installations.

For overhead installations, we provide several self-

Supports fiber optic cables, including air Messenger cables with self-function

Supporting construction.

We have a variety of fiber optic cables for flammable grades.

We offer cables that combine different types of fiber and/or copper wire, which are used as a power supply or facilitate the transition from copper wire to fiber --

There is no need to further install the basic system of the fiber optic cable.

Our hybrid cables include a range of safety cables that combine copper power supplies with fiber optic, especially for surveillance cameras and other special applications.

We also design and manufacture special fiber optic cables such as for fiber optic-to-the-Antenna (“FTTA”)

Products for cell tower construction

Military Ground tactics, industry (

Tray cable included)

Mining, deployment of broadcast, oil and gas, festoon, perforated and high density data center applications.

Our products also include fiber optic cables that meet or certify various special application standards, such as: USS.

Minister of DefensePRF-85045/8B and U. K.

Defense Minister of DefenseStan 60-

(3) qualification of military ground tactical optical cable;

Norwegian Classification Society (DNV)

Type Certificate for ship and marine platform applications; U. S.

Mine Safety and Health Administration (MSHA)

Approval for mines;

United States Shipping Bureau (ABS)

Type of cable approved.

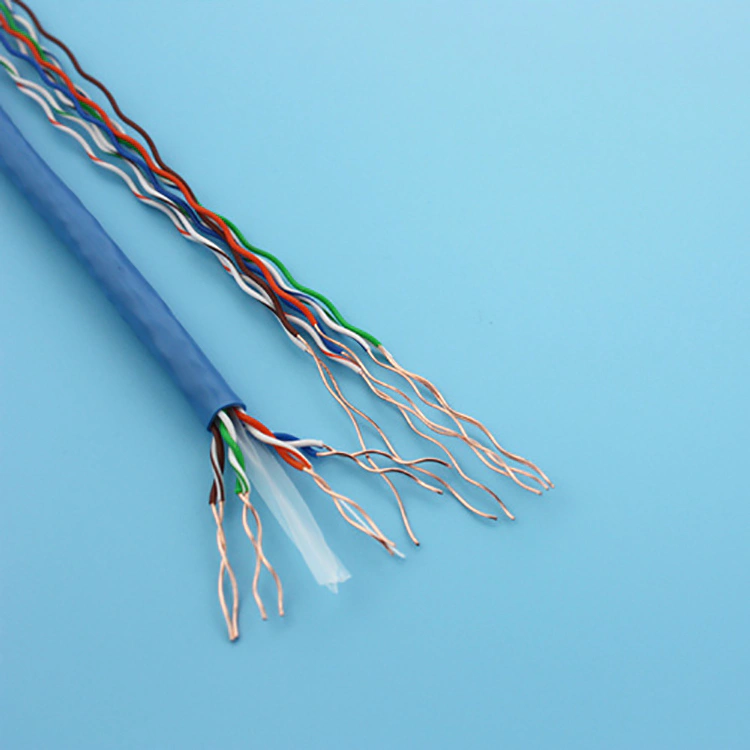

We also provide customers with a variety of custom structures to meet their specific communication needs. F/UTP)

Riser class, Class 6 and Category 6A performance class, Riser and static pressure box configuration, and structure of various colors.

The addition of copper data communication cables enables the OCC to provide terminal services to our customersto-

Terminal Solution for copper cable network installation.

Business, residential, military and harsh environmental applications.

Through our innovative technologies, our role in establishing standards for data communication for copper connections has been recognized globally. .

Our fiber optic connectivity products provide customers with comprehensive fiber optic system solutions for computer rooms, telecom cabinets, data centers and workstations, including unique infrastructure and cabling solutions for passive optical LAN (“POL”)installations.

Our products include fiber wall mount, cabinet mount and rack mount housing, pre-

Pre-connected end-to-end fiber case, fiber connector, connector tray, fiber jumper, plug-and-play Box Module

End-to-end fiber optic cable assemblies, adapters, and accessories.

OCC\'s copper enterprise connectivity products provide customers with a comprehensive range of copper system solutions, as well as a component-compliant product range required for high-speed data and voice applications in computer rooms and telecom cabinets, data centers and workstations.

Our products include: patch panel, Jack (

Standard keystone or proprietary baffle configuration)

, Plug, jumper, panel, surface mounted box, distribution and more

Media box, copper rack mounting and wall-mounted housing, cable assembly, cable organizer and other cabling products.

OCC provides products that meet the 5e, 6 and 6A standards in shielded and non-shielded products, as well as industry-recognized class 8 test qualified fixtures and class 8 plugs.

OCC pioneered the technology required for high-performance RJ45 connection applications over Ethernet with a number of patents for electrical performance and availability capabilities. .

We offer a variety of high

Performance networks, data storage, and telecom management systems for businesses and homes.

Our product line includes data cabinets, wall-mounted chassis, horizontal and vertical cable management systems, and open frame relay racks.

These products meet the needs of each network segment.

Our products serve equipment, cross-cutting

Connection and terminal requirements for copper and fiber multi-port

Media applications for passive optical LAN and ceiling mounting enclosures listed by UL for wall-mounted and space-saving. .

Our products include a comprehensive range of data communication cabling products that are made up of a wide range of enclosures, modules and modular sockets designed specifically for individual residences and multiple residences.

By using our products, customers can get a convenient way to build networks in the home, customize, distribute and manage services including voice, data, video, audio and security.

Other harsh environments and special applications.

For deployed applications, we produce a full range of tactical fiber optic connectors that meet US standards. S.

Standards of the Ministry of Defense, such:PRF-29504, MIL-DTL-83522, MIL-DTL-

83526, NAVSEA 7379171 and NAVSEA 7379172.

In addition to military designated products, we also produce EZ-MATE™, MHC®-II, MHC®-III and F-LINK™.

Many of our products feature a gender design that allows tandem assembly without considering the gender of the connector.

This design allows for rapid and easy deployment and retrieval.

To provide a more comprehensive interconnect solution, we have designed and developed a complete range of lightweight reels and accessories.

Our patented light reel and patent-pending light reel holder are approved for use by the US military.

We produce cylindrical connector products for fixed fiber, or applications where fiber and copper connections are required in the same connector.

We have made all kinds of single, duplex and multi-workers.

Channel fiber optic assemblies for mining, oil and gas, petrochemicals, broadcasting, industrial and military applications.

Our products also include rugged RJ45 connectors.

Professional and small distributors, equipment manufacturers, value-

Increased dealers, in some cases, eventuallyusers.

In general, our products are purchased by contractors, system integrators, and end customersusers.

Fiber optic cable manufacturers such as Corning, General Cable, Belden, Nexans S. A. (including Berk-Tek)

CommScope Holdings Limited, OFS, AFL (

Subsidiary of Fujikura)

Some are made of fiber.

Our copper cable product line competes with products from large copper cable manufacturers such as General Cable. , Belden Inc. , Nexans S. A. (including Berk-Tek)

CommScope Holdings Limitedand others.

Our fiber and copper connectivity product line competes with products from large fiber and copper connectivity manufacturers such as CommScope Holdings

, Corning company, Leverton, leglang S. A. (

Including ortrooper)

Panduit and others

Our product line of harsh environments and professional connectivity with Corning Corporation, Amphenol Corporation (including AFSI)

Delphi and others. 7 fiscal year.

We believe that we have complied materially with all applicable environmental regulations.

Each fiscal year ended October 31, 2017 was 3 million, 2016 and 2015.

Our research and development costs are related to a variety of research projects related to our enterprise connectivity product line, including but not limited to category 8 product development.

Product development work related to our fiber optic cable products and our harsh environment and professional connection products is usually related to product improvement and customer product development requests, it is characterized by General and administrative expenses of goods allocated to cost sales and sales, not by R & D expenses. and End-

About 50 countries used in the fiscal year 2017.

Copper connection and cable products: G facility, one of the most respected certifications in the defense industry.

We also offer American products. S.

The MoD has tactical fiber optic cable assemblies and we sell qualified fiber optic cables connected by military connectors on military reels and reels ready for deployment.

Design and manufacture all kinds of special optical fiber and mixing (

Fiber and copper)

Cable for FTTA applications such as mobile tower construction-

And upgrade.

In 2017, we employed a total of 356 people (

(Excluding independent sales representative and company).

None of our employees have union representation.

We have not encountered a shutdown and we continue to take what we see as appropriate to ensure that our employees are in good relations. 1A.

Risk factors required for \"smaller reporting companies\" as defined in Rule 12b-

2 promulgated in accordance with the revised Securities Trading Act of 1934.

The company\'s future operating results and future financial situation, as well as the company\'s future market valuation, in the \"forward-

Search for information \", including management\'s discussion and analysis of the financial position and operational results in the company\'s annual report for the financial year ended October 31, 2017 (

File as attachment 13.

Report on Form 10 1-K)

In our Quarterly Report on Form 10Q. 1B.

Unresolved employees

Our harsh environment and professional connectivity manufacturing business, our harsh environment and professional connectivity product development capabilities, our harsh environment and professional connectivity warehouses, and our central solutions business.

Our facilities in Dallas are located in the industrial complex of suites.

The rental area is approximately 34,000 square feet.

In the fiscal year 2017.

Since the various production equipment is specialized, our product portfolio is also different, in any given time, the individual manufacturing equipment may be at a higher or lower production capacity at different times.

Depending on the portfolio, certain additional production equipment may need to be purchased in order to take advantage of our excess production equipment capabilities in all of our facilities.

We cannot guarantee the time required to complete the process of recruiting and training personnel or to purchase and install certain additional production equipment or our ability to obtain additional storage space, it is necessary to take advantage of our excess production capacity. 3.

Legal proceedings Annual Report Form 10-

The deadline for October 31, 2009 is January 29, 2010)(the “SPA”).

D. did not pay any severance pay for Hazelton and did not pay any minimum income for Hazelton (

According to SPA terms, the maximum amount payable in January 31, 2017 is $470,665)

Otherwise, it would be owed to Hazelton, but Hazelton terminated for reasons and the OCC made a claim for compensation under the SPA.

Hazelton filed a lawsuit against OCC and AOS in Colin County court, Texas on September 7, 2016 (

\"Hazelton lawsuit \").

The debt is lower than the amount accrued before the minimum income amount under SPA.

As a result, lawsuits filed in the Virginia Commonwealth and Texas for the fiscal year of 2016 were dismissed and biased.

Case against William Di Bella Rose“DiBella”)(

Former staff of center Solutions)

And Rosenberg CDS, LLC and Rosenberg North America (

\"Rosenberg \")

On September 20, 2016, in the state court in Roanoke County, Virginia, related illegal acts involving Roch rs, Di Bella and Rosenberg.

On February 10, 2017, a judge of the County Court of Roanoke, Virginia, ruled that the Virginia Court lacked personal jurisdiction over Rosenberg and dismissed the allegation against Rosenberg without prejudice.

In a lawsuit filed by the Commonwealth of Virginia, the charges against Di Bella were dismissed and biased.

The claim against Roehrs is still pending.

Various other claims, legal proceedings and regulatory reviews arising during normal business operations.

The management believes that the final disposition of these matters will not have a significant adverse effect on our financial position, operating results or liquidity. 4.

Information disclosure of Mine Safety 5.

Registrant common stock and related shareholder matters common stock market and the securities ownership of management, which is proposed under the title \"beneficial ownership of securities\" in the agency statement of the company\'s 2018 annual shareholders meeting, registered here by reference.

7,315,605 shares of outstanding and outstanding common stock as of October 31, 2017.

The company has at least 37 employees and board members.

9% of outstanding and outstanding shares as of October 31, 2017, including shares that are still likely to be confiscated under attribution requirements. (

\"Repurchase plan \")

On July 14, 2015, with the approval of the board of directors, the shares purchased and withdrawn from the Company\'s common stock amounted to 400,000 shares, about 6 shares.

0% of the shares were subsequently issued.

The company is expected to complete the purchase within 24 hoursto 36-

The monthly period, but there is no clear period for repurchase. For the three-

For the one-month period ended October 31, 2017, the company did not repurchase and withdraw any outstanding shares of common stock under the scheme, and under the repurchase scheme, 398,400 shares remained to be purchased.

Repurchase the plan directly to certain shareholders and through a strange bulk repurchase offer.

In the fiscal year 2017, OCC bought back and withdrew a total of 5,701 shares at $18,122 outside the repurchase plan.

31,207, filed as Exhibit 13.

Report on Form 10 1-

K, incorporated into this article by reference. 6.

Selected Financial Data 7.

Management\'s Discussion and Analysis of the financial situation, as well as the operation\'s discussion and analysis of the financial situation and operational results \", filed as Annex 13, is our annual report for the fiscal year ended October 31, 2017.

Report on Form 10 1-

K, incorporated into this article by reference. 7A.

With regard to quantitative and qualitative disclosure of market risks 31, 2017, due to interest rate risk, foreign exchange risk, commodity price risk or stock price risk, our financial instruments do not face significant market risks. 8.

The financial statements and supplementary data of the independent CPA firm in the fiscal year report as at October 31, 2017 are filed as Exhibit 13.

Report on Form 10 1-

K, incorporated into this article by reference. 9.

Changes and disagreements with accountants in accounting and financial disclosure 2017. 9A.

Control and procedure 2017, the company has completed the evaluation under the supervision and participation of management including Chief Executive Officer and Chief Financial Officer (

Major accounting and major financial personnel)

We disclose the effectiveness of the design and operation of controls and procedures.

Based on this assessment, the chief executive officer and the chief financial officer concluded that the company\'s disclosure controls and procedures came into effect on October 31, 2017.

Annual Report on internal control of financial reports.

Involving the maintenance of records that reasonably, in detail, accurately and fairly reflect the transaction and disposal of the company\'s assets; (ii)

Provide reasonable assurance that the necessary transactions are recorded in accordance with recognized accounting principles to allow the preparation of financial statements, and that income and expenses are made only in accordance with the authorization of our management and directors of the company; and (iii)

Provide reasonable assurance to prevent or timely discover unauthorized acquisition, use or disposal of company assets that may have a significant impact on the financial statements.

The internal control system of financial reporting is based on the framework of October 31, 2017, proposing \"internal control-

The comprehensive framework issued by the Committee of Sponsoring Organizations of the Treadway committee on 2013.

On the basis of the assessment, management concluded that the company\'s internal control over financial reporting was effective as of October 31, 2017.

The internal control of the financial report for the fourth quarter of the current financial year covered in this report has or is likely to have a significant impact on our internal control of the financial report. 9B.

Other information 10.

Directors, executives and corporate governance 8 Annual Meeting of Shareholders of the company, which is incorporated into this meeting by reference.

8 Annual Meeting of Shareholders of the company, the information of which is incorporated into this meeting by reference. 16(a)

The Securities Trading Act of 1934, in which the title \"complies with Section 16 (a)

The Securities Exchange Act of 1934 was incorporated into this agreement by reference in the agency statement of the company\'s 2018 annual shareholders meeting.

The code of ethics applicable to the CEO of the company and the senior finance officer of the company required by this project is the ethics established by reference to the Company\'s Agency statement under the heading \"code of ethics. ”11.

Executive compensation 8 the annual meeting of shareholders of the company is included in this agreement as a reference. 12.

Secured ownership of certain beneficial owners, management and related shareholders includes restricted shares that have been issued and have not been issued but have not yet been vested and confiscated.

Common shares, listed under the title \"beneficial ownership of securities\" in the agency statement of the company\'s 2018 annual shareholders\' meeting, are incorporated herein by reference. 201(d)

Supervision S-

K, was established with reference to the company\'s proxy statement under the heading \"equity compensation plan information. ”13.

Certain relationships and related transactions, as well as independent directors of the annual meeting of shareholders of the company, are incorporated into the company through reference. 14.

Main accounting expenses and Services 8 of the annual meeting of shareholders of the company, incorporated into the company by reference.

Statement of proxy under the heading \"before the audit committee\"

Approval of audits and permitted non-

Audit services for independent CPA firms. ”KPMG”)

Not subject to any and all legal costs and expenses of any legal action or procedure arising from KPMG\'s successful defense report of the company\'s past financial statements referenced in this form 10-K. 15.

Detailed list of exhibits and financial statements.

In reference to pages 23 to 46 of the company\'s annual report submitted in Annex 13, the consolidated financial statements and their associated notes are combined.

Form 10-1K.

S-Regulation 601

K as follows: Form 8-

A12G submitted to the Commission on November 5, 2001).

Final proxy statement on Form 14A submitted on July 5, 2002).

Quarterly Report on Form 10

Q for the third quarter as of July 31, 2011).

Quarterly Report on Form 10

Q for the third quarter as of July 31, 2004 (file number 0-27022)).

Quarterly Report on Form 10

Q for the third quarter as of July 31, 2012). ’s Form 8-

A12G submitted to the Commission on November 1, 2011).

Annual Report on Form 10

The deadline for October 31, 2008 is January 29, 2009).

Annual Report on Form 10

The deadline for October 31, 2008 is January 29, 2009).

Annual Report on Form 10

The deadline for October 31, 2008 is January 29, 2009).

Annual Report on Form 10

The deadline for October 31, 2008 is January 29, 2009).

Annual Report on Form 10

The deadline for October 31, 2008 is January 29, 2009).

Annual Report on Form 10

The deadline for October 31, 2008 is January 29, 2009).

Current Report on Table 8

K submitted on February 22, 2010).

Quarterly Report on Form 10

Q submission for the quarter ended April 30, 2010 June 14, 2010).

Current Report on Table 8

Date: April 28, 2011.

Current Report on Table 8

Date: July 26, 2011.

Current Report on Table 8

Date: August 31, 2012.

Annual Report on Form 10

The deadline for October 31, 2015 is January 28, 2016).

Current Report on Table 8

K/A submitted on May 3, 2016).

Current Report on Table 8

K/A submitted on May 3, 2016).

Current Report on Table 8

K/A submitted on May 3, 2016).

Current Report on Table 8

K/A submitted on May 3, 2016).

Current Report on Table 8

K/A submitted on May 3, 2016).

Current Report on Table 8

K/A submitted on May 3, 2016).

Current Report on Table 8

K/A submitted on May 3, 2016).

Current Report on Table 8

K submitted on December 21, 2016).

Current Report on Table 8

Date: March 2, 2017.

Current Report on Table 8

Date: April 28, 2017.

Final proxy statement on Form 14A submitted on February 23, 2005).

Final proxy statement on Form 14A submitted on February 23, 2011).

Final proxy statement on Form 14A submitted on February 27, 2013).

Final proxy statement on Form 14A submitted on March 4, 2015).

Quarterly Report on Form 10

Q. deadline as of April 30, 2006 (submitted on June 14, 2006).

Quarterly Report on Form 10

Q. deadline as of April 30, 2009 (submitted on June 12, 2009).

Annual Report on Form 10

The deadline for October 31, 2009 is January 29, 2010).

Annual Report on Form 10

The deadline for October 31, 2009 is January 29, 2010).

Annual Report on Form 10

The deadline for October 31, 2009 is January 29, 2010).

Annual Report on Form 10

The deadline for October 31, 2009 is January 29, 2010).

Annual Report on Form 10

The deadline for October 31, 2009 is January 29, 2010).

Date: October 31, 2009, between Applied Optical Systems

Companies and G as lenders.

Thomas Hazleton Jr.

Daniel rolls (

Refer to Annex 10 for inclusion in this document.

Table 10 company annual report 29-

The deadline for October 31, 2009 is January 29, 2010).

Annual Report on Form 10

The deadline for October 31, 2009 is January 29, 2010).

Current Report on Table 8

K submitted on July 14, 2015).

Current Report on Table 8

K submitted on April 15, 2011).

Quarterly Report on Form 10

Q. deadline as of January 31, 2013 (submitted on March 15, 2013).

Quarterly Report on Form 10

Q. deadline as of January 31, 2014 (submitted on March 17, 2014).

Current Report on Table 8

K submitted on April 15, 2011).

Quarterly Report on Form 10

Q. deadline as of January 31, 2013 (submitted on March 15, 2013).

Quarterly Report on Form 10

Q. deadline as of January 31, 2014 (submitted on March 17, 2014).

Quarterly Report on Form 10

Q. deadline as of April 30, 2017 (submitted on June 13, 2017).

Notes to Consolidated Financial Statements contained herein 14).

According to section 302nd of the Sabans act, his chief executive

The Oakley Act of 2002. FILED HEREWITH.

According to section 302nd of the Sabans act, his chief financial officer-

The Oakley Act of 2002. FILED HEREWITH.

According to the chief executive of 18 statesS. C.

Section 1,350th passed under section 906th of the Sabans Act-

The Oakley Act of 2002.

Enclosed.

According to the chief financial officer of 18 US companiesS. C.

Section 1,350th passed under section 906th of the Sabans Act-

The Oakley Act of 2002.

Enclosed.

Annual Report on Form 10

K for the year ended October 31, 2017 in the format of XBRL (

Scalable Business Reporting Language): (i)

Consolidated Balance Sheets as of October 31, 2017 and 2016 ,(ii)

Consolidated Business statements as at October 31, 2017, 2016 and 2015 ,(iii)

Consolidated Statements of Shareholders\' Equity as of October 31, 2017, 2016 and 2015 ,(iv)

Consolidated Statements of Cash Flows as at October 31, 2017, 2016 and 2015, and (v)

Notes to Consolidated Financial Statements. FILED HEREWITH. 13 or 15(d)

Under the Securities Trading Act of 1934, the registrant has officially authorized the signatory to sign this report on its behalf. , 2017S/NEILD. WILKIN, JR.

President and Chief Executive of 2017 S/TRACYG.

SMITHDecember Month, 2017. , 2017S/NEILD. WILKIN, JR.

2017 S/RANDALLH.

Fraser, 2017 S/JOHNM.

2017 S/JOHNA Netherlands.

NYGREN, 2017 S/crahi.

2017 S/JOHNB Weber.

Williamson, IIIExhibit 13.

17 The table of contents discusses and analyzes the financial position and operating equity results for the OCCFiscal al year 2015, including $2. 4 million non-

Cash charges related to setting allowances for OCC net deferred tax assets.

Deferred tax asset valuation allowance for the fiscal year 2015 increased income tax expenses, increased net losses, increased net losses attributable to OCC, reduced total assets attributable to OCC, total shareholder equity attributable to OCC decreased by $2 per item. 4 million.

The deferred tax asset valuation allowance also increased the net loss per share of OCC by $0.

£ 39 per share for the fiscal year 2015.

See \"income tax fees (Benefit)

\"In the Management Discussion and Analysis section of this year\'s report and in note 12 to consolidated financial statements. ):Progress. Adjustments.

Significant progress was made in the fiscal year 2017, facing market challenges and necessary adjustments.

Maintain our strong market position in other markets. —

Sales growth offset weakness in other markets.

In fiscal 2017, we grew up with certain larger strategic distribution partners and our distribution partners.

Overall, our corporate market sales remained relatively stable in 2017, especially compared to the challenges faced by some of the OCC\'s competitors.

We also focus on operational plans designed to improve manufacturing efficiency and process improvement. t 5.

During the financial period of 4% in 2017, we increased our combined gross profit margin by 32.

4%, gross profit margin for all product categories: fiber optic cables, enterprise connections and harsh environments and professional connections has increased.

In a challenging market environment, we overcome the weaknesses of certain enterprise markets, especially in the second half of 2017, and the weaknesses of our military and wireless operator markets.

Fiscal year ended 2017and bottom-

Similar financial performance in the previous fiscal year. 2017.

These adjustments include recruiting key new people and making organizational and team changes to drive our seniorline growth.

At the end of fiscal 2017, our fiber optic cable manufacturing plant launched a new operational excellence program designed to improve operational efficiency.

The main financial performance indicators for the fiscal year 2017 included: the million in the fiscal year 2016, a decrease of less than 1%.

During the year, the OCC has achieved strong sales growth in certain industrial and professional markets as well as some of our larger strategic distribution partners.

Our business market is relatively stable, we have achieved

Despite the weak market for our military and wireless operators and the decline in sales outside the US, the line is stableS.

Net sales for the fiscal year 2017 were $14.

The first quarter grew to $6 million.

To 2 million in the fourth quarter.

Akin increased to 32.

Compared to 30 4%.

Our category of fiber optic cables, enterprise connectivity, and harsh environments and professional connectivity products increased during the fiscal year 2016 at 5%.

Last year, we focused on positively impacting future sales growth, in part because of the selection of new employees, increased marketing spending and targeted employee incentives.

This year\'s growth is in line with our strategic move after SG saved $3.

Compared with the fiscal year 2016, the fiscal year 2015 was 3 million per cent.

Our ability to maintain an enviable market position in the target market relative to larger competitors often requires SG & A expenses to be higher in net sales than those larger competitors.

China\'s balance sheet remains strong.

The ratio of OCC Current Assets to current liabilities is 6.

5 to 1 as of October 31, 2017.

In the fiscal year 2017, we extended the maturity date of the real estate loan to May 2024 with a fixed rate of 3. 95%. OCC’s long-

Compared with some of our industry competitors, the ratio of regular debt to shareholders\' equity is relatively low. —

Accelerate sales and marketing initiatives in target markets and focus on improving operational efficiency and process improvement --to drive top-and bottom-line growth.

We continue to work hard and we are starting to see an increase in sales activity during the fiscal year 2017. —

Especially in the military and some other professional markets.

Therefore, we believe that sales in the first quarter of fiscal 2018 may increase considerably compared with the same period last year. —

Develop and maintain a fairly enviable market position in our target market and build loyalty among our customers and others who rely on our products.

We are optimistic about our ability to remain strong in these markets. —

So we said. . . ®/S/Neil DWilkin, Jr.

Chairman of the board of directors, Discussion and Analysis of Financial Position and operational results \")

, Future results of the company\'s operations and future financial position, and/or future equity value of the company.

Factors that may lead to or contribute to this difference or that may adversely affect the Company include, but are not limited to: the level of sales to major customers, including distributors;

Schedule of certain projects and purchases of major customers;

Affecting the economic conditions of network service providers;

Expenditures of companies and/or governments on information technology;

The actions of competitors;

Fluctuations in raw material prices (

Including precious metals such as optical fiber, copper, gold, plastic and other materials);

Fluctuations in transportation costs;

Our reliance on custom equipment in order to produce certain of our products in certain production facilities;

The ability to protect our proprietary manufacturing technology;

Market conditions that affect the price or pricing of one or more markets we participate in, including the impact of increased competition;

Our dependence on a limited number of suppliers;

Loss or conflict with one or more key suppliers or customers;

Adverse results of litigation, claims and other proceedings, as well as potential litigation, claims and other proceedings against us;

Adverse results of regulatory review and audit and potential regulatory review and audit;

Adverse changes affecting our state tax law and/or the position of state tax authorities;

Technological change and introduction of new competitive productschanges in end-

User preferences for competitive technologies related to our products;

Economic conditions affecting the telecom sector, the data communications sector, certain technical sectors and/or the market sectors of certain industries (

Mining, oil and gas, military and wireless transport industries, for example);

Factors affecting the US economyS.

Based on the manufacturer;

Changes in economic conditions or relative monetary advantages (

S. economy, for example. S.

USD relative to some foreign currency)

This affects the relative cost of certain geographic markets, the United States. S.

Export products and/or the economy as a whole;

We offer private labels to connect changes in demand for our products from certain competitors of the product;

Changes in the portfolio of products sold for any given period (

Among other things, due to the seasonality or strengths or weaknesses of the particular market we are involved in)

May affect gross profit, gross profit margin or net sales;

Changes in order and output of hybrid cables (

Fiber and copper)

High copper content and low gross profit margin;

Changes caused by high volatility, large sales orders and high sales concentration of a limited number of customers in the wireless operator market;

Terrorist attacks or acts of war, as well as any current or future military conflicts that may occur;

Changes in the level of US government military spending or other spending, including, but not limited to, reductions in government spending due to automatic budget cuts or segregation;

Ability to recruit and retain key personnel;

Poor labor relations;

Changes in accounting policies and the impact of compliance-related costs, including the Securities and Exchange Commission (“SEC”)

Accounting supervision committee of public companies (“PCAOB”)

Committee on Financial Accounting Standards (“FASB”)

And/or the International Accounting Standards Board (“IASB”);

We continue to successfully comply with the capabilities and compliance costs set out in Section 404 of Sabans-

The Oakley Act of 2002 or any amendment to which this Act applies to us;

Changes and potential changes in federal laws and regulations adversely affect our business and/or lead to an increase in our direct and indirect costs, including the direct and indirect costs of our compliance with these laws and regulations;

Impact of the Patient Protection and Affordable Care Act of 2010 and the Health Care and Education Reconciliation Act of 2010, any amendments to the bills that apply to us, as well as the relevant legislation and regulations related to these bills, directly or indirectly, result in an increase in our costs;

Changes in state or federal tax laws and regulations increase the impact of our costs and/or on the net return of investors holding our shares;

Any change in our compliance with the lender\'s financial debt deed;

We maintain and/or ensure the capacity of debt financing and/or equity financing to fully fund our ongoing operations;

The impact of future integration between competitors and/or customers adversely affects us and our customers and/or our market position;

Customer actions adversely affect our product expansion, including but not limited to the provision of products that compete with customers, and/or alliances, investments or cooperation with them, parties that compete with our customers and/or conflict with our customers;

The company\'s common stock is voluntarily or involuntarily delisted from any exchange on which it is traded;

Due to the small number of holders of the Company\'s common stock, the company canceled the registration required by the SEC report;

Continued suspension of dividends declared to shareholders due to insufficient or alternative use of cash on hand;

Adverse reactions of customers, suppliers or other service providers to unsolicited advice on ownership or management of the company;

Consideration, response and possible defense of additional costs to our position on unsolicited proposals regarding ownership or management of the company;

The impact of weather or natural disasters on the world region in which we operate, sell products and/or acquire raw materials;

The number of outstanding and outstanding shares of the Company\'s common shares has increased;

One or more markets in which we operate are in general and/or there is a further recession;

Changes in market demand, exchange rate, productivity, market dynamics, market confidence, macroeconomic and/or other economic conditions in the world region where we operate and sell products;

And our success in managing the risks mentioned above. -

And/or in our other documents. ®)

Is a leading manufacturer of optical fiber and copper data communication cabling and connectivity solutions, mainly for the enterprise market and a variety of harsh environments and professional markets (the non-Operator market)

Provide an integration suite of high quality products, run as a system solution, or seamlessly integrate with products from other providers.

Our products include installation from enterprise networks, data centers, residential and campus to special applications and harsh environments (including military, industrial, mining, petrochemical and broadcast applications) customized products and other uses as well as the wireless operator market.

Our products include fiber and copper cable, fiber and copper cable connectors, special fiber and copper cable connectors, fiber and copper cable jumpers, pre-

End-to-end fiber and copper cable assemblies, racks, cabinets, data communication enclosures, patch panels, panels, multiple

Media boxes, fiber optic reels and accessories and other cable and connection management accessories designed to meet the most demanding needs of the terminal

Provides a high degree of reliability and superior performance.

®Is an international recognized pioneer in the design and production of fiber optic cables for the most demanding military applications, as well as fiber optic cables suitable for indoor and outdoor, based on the development of these basic technologies, create a wide range of products.

OCC was also recognized by the International for taking the lead in developing innovative copper connection technologies and designs for meeting industrial copper connection data communication standards.

G certification, the main production enterprises contact the products of Ville City in our factory is ISO 9001: 2008 registered, the products specially connected to Dallas for harsh environment mainly produced in our factory are ISO 9001: 2008 registration and MIL-STD-790G certified.

®With the efforts of our integrated OCC sales team.

Center Solutions Co. , Ltd. , a wholly owned subsidiary of the company (

\"Center solution \")

Provide cabling and connectivity solutions for the data center market.

Centric solution\'s business is located at the OCC factory near Dallas, Texas.

®South River®Three blades in Nanhe™Advanced Modular Products™SMP Data Communication™Applied Optical System™Focus on solution™The relevant logo is the trademark of the optical cable company.

Consolidated net sales for the fiscal year 2017 were $64.

1 million, a decrease of less than 1% compared to $64 in net sales.

The fiscal year 2016 was 6 million per cent.

In the fiscal year 2017, net sales of OCC in the enterprise market remained relatively stable, while OCC achieved growth in some industrial and professional markets.

These increases were offset by a decline in net sales for wireless operators and the military market.

Gross profit is $20.

In 2017 of the 8 million fiscal year, an increase of 5.

Compared with $19, 4%.

The fiscal year 2016 was 7 million per cent.

Gross margin or gross margin increased to 32 as a percentage of net sales.

The fiscal year 2017 was 4% per cent, compared to 30 per cent.

The fiscal year 2016 was 5% per cent.

In the fiscal year 2017, the gross profit margin of all product categories in OCC has increased, including fiber optic cables, enterprise connectivity, and harsh environments and professional connectivity, and is positively affected by the portfolio.

Sales, general and administrative expenses increased by 5. 8% to $22.

The fiscal year 2017 was $0 m, compared to $20.

The fiscal year 2016 was 8 million per cent.

The increase in SG & A expenses includes the selection of new employees, certain employee incentives and increased marketing spending as we focus on initiatives that positively impact future sales growth.

Includes total product sales minus discounts, refunds and returns.

Revenue is confirmed when the product is shipped or delivered to the customer (

Including distributors)

The premise is that the customer has ownership and bears the risk of loss (

Based on shipping terms)

The collection of related accounts receivable is possible, there is evidence of persuasive arrangements, and the sales price is fixed or determinable.

Our customers generally do not have the right to return the product unless it is defective or damaged and within the parameters of the product warranty.

Including material costs, product warranty costs and compensation costs, as well as indirect costs and other costs related to our manufacturing business.

The maximum percentage included in the cost of selling goods is due to material costs. (\"SG & A fee \")

Including compensation expenses for sales and marketing personnel, transportation expenses, trade show expenses, customer support expenses, travel expenses, advertising, bad debt expenses, compensation expenses for administrative and management personnel, legal, accounting, consulting and professional fees resolve costs incurred in respect of our actions or claims and other proceedings, as well as other costs associated with our operations.

Includes royalties and related fees, deducting royalties earned (if any) from licenses related to our patented products ).

Includes cost amortization related to the Granted internal development patent, including legal fees.

Amortization of intangible assets is calculated using a straight line method on the estimated service life of intangible assets.

Includes interest charges and other miscellaneous income and expense items that are not directly attributable to our operations. 7 were $64.

1 million, a decrease of less than 1% compared to $64 in net sales.

The fiscal year 2016 was 6 million per cent.

Net sales in the enterprise market (including OEM)

OCC remained relatively stable compared to the fiscal year 2016, while some industrial and professional markets achieved growth.

However, these increases were offset by a decline in net sales for wireless operators and the military market. 6 were $64.

6 million, a decrease of 12.

Net sales were $73, or 2%.

The fiscal year 2015 was 6 million per cent.

At the end of the fiscal year 2015, the OCC experienced abnormal weakness in many markets and continued until the beginning of the fiscal year 2016, which in particular affected net sales for the first quarter ended January 31, 2016, more than the historical quarter seasonality of the OCC.

Net sales for the fiscal year 2017 were 20%, 20% and 22%, respectively, 2016 and 2015.

Compared with the fiscal year 2017, net sales to US customers increased slightly in the fiscal year 2016, while net sales to customers outside the US decreased by 5. 3%. —

Especially in the military and some other professional markets.

Therefore, we believe that sales in the first quarter of fiscal 2018 may grow considerably compared to the same period last year. increased 5. 4% to $20.

The fiscal year 2017 was $8 million.

The fiscal year 2016 was 7 million per cent.

Gross margin or gross margin increased to 32 as a percentage of net sales.

The fiscal year 2017 was 4% per cent, compared to 30 per cent.

The fiscal year 2016 was 5% per cent.

Products for the fiscal year 2017 include fiber optic cables, enterprise connectivity, harsh environments, and professional connectivity, mainly due to the shift in the portfolio to selling certain products with higher profit margins compared to the fiscal year 2016.

By the end of the fiscal year 2017, we launched new manufacturing efficiency initiatives that we believe will benefit the OCC in the coming period. 19.

The fiscal year 2016 was 7 million, a 9.

A decrease of 5% from $21.

The fiscal year 2015 was 8 million per cent.

Gross profit margin is 30.

The fiscal year 2016 was 5% per cent, compared to 29 per cent.

The fiscal year 2015 was 6% per cent.

Compared with the fiscal year 2016, the increase in gross profit margin for the fiscal year 2015 is mainly due to the increase in net sales of certain optical cable products, which has a positive impact on gross profit margin, and net sales reduce sales of certain optical cable products that have a negative impact on the previous gross profit.

In addition, joint efforts to reduce manufacturing costs and improve production efficiency have significantly increased our gross profit margin in the third and fourth quarters of fiscal 2016, compared with the same period in the fiscal year 2015, compared with the fiscal year 2016 and the fiscal year 2015, there has been an increase.

The fiscal year 2017 was millions of dollars.

The fiscal year 2016 was 8 million per cent.

SG & A expenses as A percentage of net sales are 34.

The fiscal year 2017 was 3% per cent, compared to 32 per cent.

The fiscal year 2016 was 1% per cent.

A compared with the financial period from 2016 to 2017, the main reason for the increase in annual expenses is that the total amount of related expenses of employees is $837,000, the total cost of marketing is $170,000, and the total legal cost is $164,000.

When comparing the 2017 fiscal year with the 2016 fiscal year, employee-related costs increased, mainly due to new employees, selective increases to achieve strategic objectives, and increased costs for medical insurance.

Due to some new marketing plans and work related to future product launches, marketing costs have increased.

The increase in legal costs is mainly due to legal action taken by the company in the first six months of the fiscal year 2017.

This legal action resulted in a favourable resolution of certain legal matters in the second quarter of the fiscal year 2017.

Thus, the reversal of approximately $171,000 previously accrued was included in the \"net other expenses\" described below.

As expected, legal costs for the second half of 2017 did not reach the same level.

The fiscal year 2016 was millions of dollars.

In line with our efforts to control and reduce costs, the fiscal year 2015 was € 0 M.

SG & A charges as A percentage of net sales are 32.

The fiscal year 2016 was 1% per cent, compared to 32 per cent.

The fiscal year 2015 was 7% per cent.

The fiscal year 2017 was $20,000, compared to $164,000 for the fiscal year 2016.

We expect that due to the expiration of licensed product patents resulting in a decline in royalties revenue, the trend of royalties fully offsetting royalties revenue will continue in 2018.

The fiscal year 2016 was $64,000, compared to $124,000 for the fiscal year 2015.

The amortization expenses for the fiscal year 2017 were 26,000 related to intangible assets, compared with $17,000 for the fiscal year 2016 and $11,000 for the fiscal year 2015.

Net Other expenses for the fiscal year 2017 decreased compared to the fiscal year 2016, mainly due to income of approximately $171,000, as a result of the previous reversal of the accrued amount upon favorable resolution of certain legal matters and the reduction of interest rates, effective from December 21, 2016, as well as changes in the balance of our revolving credit note.

The main reason is the increase in gross profit by $1.

1 million, offset by an increase of $1 in SG & A fees.

Compared with the fiscal year 2017, the fiscal year 2016 was 2 million per cent.

The improvement was mainly due to A $3 reduction in SG & A costs.

Compared with 2016, the fiscal year 2015 was 3 million, partially offset by a $2 decrease in gross profit.

Compared with the fiscal year 2016, the fiscal year 2015 was 1 million per cent. (Benefit)

Our effective tax rate for the fiscal year 2015 was significantly affected by the establishment of $2 in the fourth quarter of the fiscal year 2015.

4 million valuation allowance for all of our deferred tax net assets, which is a non-

Cash charges increase our net loss of $2 attributable to the OCC for the fiscal year 2015.

4 million, or $0. 39 per share.

In the fiscal year 2015, if we generate sufficient taxable income in the subsequent period to achieve some or all of our deferred income tax net assets, the tax benefits resulting from the necessary reduction in our valuation allowance, our effective income tax rate may be unusually low.

In addition, if we generate pre-tax losses in the subsequent period, as in the 2017 fiscal year, our effective income tax rate may also be unusually low, as our net deferred tax assets increase due to net operating losses for tax purposes, they will be offset by a corresponding increase in our valuation allowance for deferred tax net assets.

The main reason is the $51,000 reduction in Pre-Income tax losses. 527,000, or 1. 3%, to $40.

As at October 31, 2017, $1 million, from $40.

October 31, 2016 for 7 million.

The decrease was mainly due to $1.

Property, plant and equipment decreased by 2 million and cash decreased by $988,000, partially offset by an increase in inventory of $1. 8 million.

More details on cash reduction are provided in our discussion on \"liquidity and capital resources.

The decrease in property, factories and equipment was due to the fact that depreciation expenses were greater than the increase in assets during the fiscal year 2017.

Due to the planned replenishment of the inventory to sufficient levels and the timing of the purchase of certain raw materials, the inventory has increased.

An increase of $549,000, or $3. 5%, to $16.

As at October 31, 2017, $4 million, $15.

October 31, 2016 for 9 million.

The increase in total liabilities is mainly due to an increase of $700,000 in notes payable to banks under our revolving credit mechanism.

Share capital fell by $1 in October 31, 2017. 1 million, or 4.

3%. for the fiscal year 2017.

The main reason for the decrease was the net loss of $1.

7 million, partially offset by shares-

A salary of $681,000 is deducted.

7 have been providing funds for liquidity needs and capital expenditures and in the long termterm debt.

For this purpose, our main source of capital is cash available, cash provided by operations, and advance payments for Revolving credit loans.

As of October 31, 2017 and 2016, there was an outstanding loan balance under our revolving credit loan, totaling $5.

$7 million and $5.

0 million respectively.

As of October 31, 2017 and 2016, we had outstanding loan balances, in addition to Revolving credit loans, totaling $6.

$7 million and $6.

9 million respectively. 891,000 and $1.

As at October 31, 2017, 9 million and 2016 respectively.

Net cash provided for fund-raising activities was $283,000, offset by net cash used for operating activities of $687,000 and total capital expenditure of $509,000.

2017. we have $22 working capital.

9 million, $22.

As at October 31, 2016 for 2 million.

As at October 31, 2017, the ratio of current assets to current liabilities was 6.

5 to 1 to 6.

4 to 1 as of October 31, 2016.

Compared to October 31, 2017, the increase in current and current ratios as at October 31, 2016 was mainly due to $1.

Inventories increased by 8 million, partially offset by a $988,000 reduction in cash.

In the fiscal year 2017, funds for operating activities amounted to $687,000, while net cash provided for operating activities amounted to $3.

The fiscal year 2016 was $2 million.

The fiscal year 2015 was 2 million per cent.

The fiscal year 2017 was $584,000, compared to $676,000 for the fiscal year 2016, which was $3.

The fiscal year 2015 was 2 million per cent.

The net cash used for investment activities in the fiscal years 2017, 2016 and 2015 is mainly derived from the purchase of property and equipment and deposits for the purchase of property and equipment.

Total Cash provided for financing activities for the fiscal year 2017 was $283,000, while net cash used for financing activities was $1.

7 million for the fiscal year 2016, net cash from financing activities amounted to $2.

The fiscal year 2015 was 0 million.

700,000 partially offset by long-term principal payments

A total of $276,000 in regular debt.

The net cash used in financing activities for the fiscal year of 2016 is mainly derived from the repayment of Revolving credit loans, totaling $1.

Our long-term principal payment

The total amount of regular debt was $281,000, the total amount of dividend payments previously announced was $141,000, and the total cost of refinancing was $138,000.

The net cash provided by the financing activities for the fiscal year 2015 is mainly derived from the proceeds of the notes paid to our bank based on our credit line, deducting the repayment, which is $3.

5 million, partially offset by the previously announced dividend payment of $556,000 and the $80,636 repurchase and withdrawal of 380,000 shares of our common stock.

According to this repurchase plan, we still have 398,400 shares to buy.

7, in addition to the repurchase plan, we repurchased and retired a total of 5,701 shares for $18,000. note.

We signed a loan amendment agreement (\"Agreement \")

As a successor to the Bank of North Carolina, along with the financial partners of Pinnacle ,(“Pinnacle”)

In order to amend the credit agreement signed between the company and Pinnacle on April 26, 2016, the Company shall pay the April 26, 2016 revolving credit note to Pinnacle and the April 26, 2016 term loan that the Company shall pay to Pinnacle.

We entered into a third loan amendment agreement with Pinnacle to amend the April 26, 2016 credit agreement signed by the company with Pinnacle and the April 26, 2016 term loan.

Pinnacle provided $7 for the company.

Million revolving credit line (

(Revolving loan)

Meet our working capital needs

According to the revolver, Pinnacle provides us with one or more revolving loans with a collective maximum principal of $7. 0 million.

When a revolving loan comes into effect, we can borrow, repay and reborrow at any time or from time to time.

Pinnacle causes a reduction in the margin applicable in the revolving credit note and sets a lower limit of interest rates for the revolving credit note, making the interest rate never less than 2. 50% per annum.

The revolving loan is interest rate by LIBOR plus 2. 50% (

Lead to a 3.

73% in October 31, 2017).

The revolving loan only pays interest on a monthly basis in the event of principal and any outstanding interest due.

Loan with Pinnacle)

About $2.

Credit available 0 million7.

In our budget process for fiscal 2017, we included an estimate of capital expenditure of $2.

£ 0 a year.

We spent a total of $509,000 on new manufacturing equipment, improvement of existing manufacturing equipment, new information technology equipment and software, upgrading of existing information technology equipment and software, etc. Capital 2017 furniture and other capitalized expenditures for property, plant and equipment in the fiscal year.

During the fiscal year budget process, we included an estimate of capital expenditure of $2.

£ 0 a year.

Any capital expenditure will be funded, as appropriate, from our working capital, cash provided by operations or loans under our credit mechanism.

This amount includes an estimate of capital expenditures for similar items purchased in the fiscal year 2017.

Capital expenditures are reviewed and approved on a variety of factors, includes, but is not limited to, current cash flow considerations, expected return on investment, project priorities, impact on current or future product supply, availability of personnel required to implement and start using acquired equipment, and overall economic conditions.

Historically, in most fiscal years, our capital expenditures are lower than the budget.

48%, 47% and 49% of our net sales occurred in the first half of 2017, 2016 and 2015 respectively, with an average of about 52%, and 53% and 51% of our net sales occurred in the second half of 2017, 2016 and 2015 respectively.

The important judgment is usually due to the need to estimate things that are inherently uncertain.

The month (b)

Securities registered under article 12 (g)

Behavior: no eyes☐No. ☒Section 13 or 15 (d)

Securities Trading Act of 1934.

Yes. ☐No. ☒All reports requested in Section 13 or 15 have been submitted (d)

Securities Trading Act of 1934 within the first 12 months (

Or a short period of time required for the registrant to submit such reports), and (2)

This filing requirement has been bound for the last 90 days. (1)Yes☒No☐(2)

Yes. ☒No. ☐Regulation 405-

12 months before T (

Or in such a short time that the registrant is required to submit and publish these documents).

Yes. ☒No. ☐S-regulation 405K (Section 229.

This Chapter 405)

As the registrant is aware, it is not included here and will not be included in the final proxy or information statement referenced in Part 3 of this form --

K or any amendments to this form 10K.

☐☐Speed up Filer☐Non

Speed up Filer☐Small Reporting Company☒☐☐Yes. ☐No. ☒Non-held common stock with no face value

Related Companies of registrants (

Does not recognize that any of the shares are not included in the determination of such value is a related company)

As of April 30, 2017, according to the NASDAQ Global Market Report of April 30, 2017, the last working day of the company in the most recent second quarter was $13,802,066.

In December 12, 2017, the company issued 7,305,988 shares of common stock.

Annual report submitted as Annex 13.

Report on Form 10 1-

K incorporated by reference in the second part of this table 10

K report: \"Company Information\", \"Management Discussion and Analysis of financial status and results of operations\", \"notes to consolidated financial statements\", Report of Independent CPA firm.

\"In addition, part of the agency statement of the company\'s 2018 annual shareholders meeting is incorporated by reference in part 3 of this form 10.

K report: \"Election of Directors\", \"beneficial ownership of securities\", \"executive compensation\", \"remuneration of directors\", \"compliance with Section 16th (a)

Securities Trading Act of 1934, code of ethics, executive compensation, beneficial ownership of securities, information on equity compensation plans, \"certain relationships and related transactions\", \"independent registration accounting firm and Audit Committee

Approval of audits and permitted non-

Audit services for independent CPA firms. ”1. 1A. 1B. 2. 3. 4. 5.

Equity and related shareholders. 6. 7.

Discussion and Analysis of financial status and operational results. 7A. 8. 9. 9A. 9B. 110. 211. 212. 213. 214.

Fees and services. 315. 481. BUSINESS265-0690.

Optical cable company and our wholly owned subsidiary Applied Optical Systems Company(“AOS”)

And center Solutions Co. , Ltd (

\"Center solution \")

With office, manufacturing and warehouse facilities in Roanoke, Virginia, close to Asheville, North Carolina and Dallas, Texas. ®”)

Is a leading manufacturer of optical fiber and copper data communication cabling and connectivity solutions, mainly for the enterprise market and a variety of harsh environments and professional markets (the non-Operator market)

Provide an integration suite of high quality products, run as a system solution, or seamlessly integrate with products from other providers.

OCC also produces and sells products in the wireless carrier market.

Our products include designs for uses ranging from enterprise networks, data centers, residential and campus facilities to customized products for special applications and harsh environments (including military, industrial, mining, petrochemical), etc, wireless operators and broadcast applications. -

Integrate communication solutions by bundling our products into systems that serve our customers and terminals

Users with integrated cabling and connectivity solutions

Suitable for personal data communication and application needs.

®Is an international recognized pioneer in the design and production of fiber optic cables for the most demanding military applications, as well as fiber optic cables suitable for indoor and outdoor, based on the development of these basic technologies, create a wide range of products.

OCC®It is also an international recognized pioneering and innovative copper connection technology and design to meet the development of copper data communication standards in the industry.

Mainly registered with ISO 9001: 2008 and MIL-STD-

790G certified factory located in Roanoke, Virginia, mainly in ISO 9001: 2008 registered factory located near Asheville, North Carolina, producing enterprise connection products and mainly in ISO 9001: 2008 registration and MIL-STD-

790G certification facility near Dallas, Texas.

Enterprise, harsh environment, professional market and application.

We call these products our fiber optic cable products.

OCC designs, develops and manufactures fiber and copper connectivity products for the enterprise market, including a wide range of enterprise and residential applications.

We call these products our enterprise connection products.

The OCC is mainly used in military, harsh environments and other special applications to design, develop and manufacture a wide range of professional fiber optic connectors and connection solutions.

We call these products our harsh environment and professional connected products.

Provide harsh environment and professional connectivity products through AOS called optical cable company and OCC®With the efforts of our integrated OCC sales team.

Center Solutions Co. , Ltd. , a wholly owned subsidiary of the company (

\"Center solution \")

Provide cabling and connectivity solutions for the data center market.

Centric solution\'s business is located at the OCC factory near Dallas, Texas.

®South River®Three blades in Nanhe™Advanced Modular Products™SMP Data Communication™Applied Optical System™Focus on solution™And the relevant logo is the trademark of the optical cable company.

®Is a leading manufacturer of optical fiber and copper data communication cabling and connectivity solutions, mainly for the enterprise market and a variety of harsh environments and professional markets (the non-Operator market)

Provide an integrated set of high-quality, guaranteed products that operate as a system solution or seamlessly integrate with products from other providers.

OCC also produces and sells a large number of products in the wireless carrier market.

OCC\'s products include designs for a variety of uses, from enterprise networks, data centers, residential and campus facilities, to customized products for harsh environments and special applications, including military, industrial, mining wireless operators and broadcast applications.

In the past two years, the OCC has obtained or received a license notice for 23 fiber and copper connections and patents for innovative design of fiber optic cables.

Mainly for the enterprise market and various harsh environments and professional markets (the non-Operator market)

Including enterprise networks, data centers, residential and campus facilities, as well as the demand for harsh environments and professional markets such as military, industrial, mining, petrochemical and broadcasting applications, to a lesser extent.

OCC also produces and sells a large number of fiber optic cables and hybrid cables (

Fiber and copper)

Products in the wireless operator market.

Our patents.

Buffer fiber unit cable with high fiber-

Calculated and rugged in a compact and lightweight design.

We believe we provide the most comprehensive

Provide buffer optical cable products for our market. (

Fiber and copper)

And cables with special fibers.

In some installations, we can provide additional protection for fiber optic cables.

We offer cables for underground or overhead installations.

For overhead installations, we provide several self-

Supports fiber optic cables, including air Messenger cables with self-function

Supporting construction.

We have a variety of fiber optic cables for flammable grades.

We offer cables that combine different types of fiber and/or copper wire, which are used as a power supply or facilitate the transition from copper wire to fiber --

There is no need to further install the basic system of the fiber optic cable.

Our hybrid cables include a range of safety cables that combine copper power supplies with fiber optic, especially for surveillance cameras and other special applications.

We also design and manufacture special fiber optic cables such as for fiber optic-to-the-Antenna (“FTTA”)

Products for cell tower construction

Military Ground tactics, industry (

Tray cable included)

Mining, deployment of broadcast, oil and gas, festoon, perforated and high density data center applications.

Our products also include fiber optic cables that meet or certify various special application standards, such as: USS.

Minister of DefensePRF-85045/8B and U. K.

Defense Minister of DefenseStan 60-

(3) qualification of military ground tactical optical cable;

Norwegian Classification Society (DNV)

Type Certificate for ship and marine platform applications; U. S.

Mine Safety and Health Administration (MSHA)

Approval for mines;

United States Shipping Bureau (ABS)

Type of cable approved.

We also provide customers with a variety of custom structures to meet their specific communication needs. F/UTP)

Riser class, Class 6 and Category 6A performance class, Riser and static pressure box configuration, and structure of various colors.

The addition of copper data communication cables enables the OCC to provide terminal services to our customersto-

Terminal Solution for copper cable network installation.

Business, residential, military and harsh environmental applications.

Through our innovative technologies, our role in establishing standards for data communication for copper connections has been recognized globally. .

Our fiber optic connectivity products provide customers with comprehensive fiber optic system solutions for computer rooms, telecom cabinets, data centers and workstations, including unique infrastructure and cabling solutions for passive optical LAN (“POL”)installations.

Our products include fiber wall mount, cabinet mount and rack mount housing, pre-

Pre-connected end-to-end fiber case, fiber connector, connector tray, fiber jumper, plug-and-play Box Module

End-to-end fiber optic cable assemblies, adapters, and accessories.

OCC\'s copper enterprise connectivity products provide customers with a comprehensive range of copper system solutions, as well as a component-compliant product range required for high-speed data and voice applications in computer rooms and telecom cabinets, data centers and workstations.

Our products include: patch panel, Jack (

Standard keystone or proprietary baffle configuration)

, Plug, jumper, panel, surface mounted box, distribution and more

Media box, copper rack mounting and wall-mounted housing, cable assembly, cable organizer and other cabling products.

OCC provides products that meet the 5e, 6 and 6A standards in shielded and non-shielded products, as well as industry-recognized class 8 test qualified fixtures and class 8 plugs.

OCC pioneered the technology required for high-performance RJ45 connection applications over Ethernet with a number of patents for electrical performance and availability capabilities. .

We offer a variety of high

Performance networks, data storage, and telecom management systems for businesses and homes.

Our product line includes data cabinets, wall-mounted chassis, horizontal and vertical cable management systems, and open frame relay racks.

These products meet the needs of each network segment.

Our products serve equipment, cross-cutting

Connection and terminal requirements for copper and fiber multi-port

Media applications for passive optical LAN and ceiling mounting enclosures listed by UL for wall-mounted and space-saving. .

Our products include a comprehensive range of data communication cabling products that are made up of a wide range of enclosures, modules and modular sockets designed specifically for individual residences and multiple residences.

By using our products, customers can get a convenient way to build networks in the home, customize, distribute and manage services including voice, data, video, audio and security.

Other harsh environments and special applications.

For deployed applications, we produce a full range of tactical fiber optic connectors that meet US standards. S.

Standards of the Ministry of Defense, such:PRF-29504, MIL-DTL-83522, MIL-DTL-

83526, NAVSEA 7379171 and NAVSEA 7379172.

In addition to military designated products, we also produce EZ-MATE™, MHC®-II, MHC®-III and F-LINK™.

Many of our products feature a gender design that allows tandem assembly without considering the gender of the connector.

This design allows for rapid and easy deployment and retrieval.