Premier Cable Manufacturer in China

optical cable corporation (occ)

by:AAA

2021-01-13

Washington, D. C. Securities and Exchange CommissionC.

20549 Sentences: From 10 sentences:

The report is based on the month or month to be taken (d)

Commission File Number of the Securities Trading Act for the fiscal year 19-34 ended October 31, 2016 0-

27022________________________________________________OPTICAL cable the company

The exact name of the registrant specified in the articles of association)

________________________________________________ Virginia54-1237042(

State or other jurisdiction of company or organization)(I. R. S.

Employee Identification Number)

Va2419 5290 Roanoke CommScope Avenue (

Main executive office address)(Zip Code)(540)265-0690(

Registrant phone number, including area code)

Securities registered under section 12th (b)

The act: non-citizenship registered under section 12 (g)

Title of the act: title of each class name of each exchange registered common stock, global market without face value

Well-known experienced issuers as defined in Rule 405 of the Securities Act.

Yes. ☐No. ☒Indicate by check mark whether the registrant does not need to submit a report under Section 13 or section 15 (d)

Securities Trading Act of 1934.

Yes. ☐No. ☒Indicate by check mark whether the registrant (1)

All reports requested in Section 13 or 15 have been submitted (d)

Securities Trading Act of 1934 within the first 12 months (

Or a short period of time required for the registrant to submit such reports), and (2)

This filing requirement has been bound for the last 90 days. (1)Yes☒No☐(2)

Yes. ☒No. ☐Indicate by check mark whether the registrant has electronically submitted and posted on his company\'s website (if any), each Interactive Data File submitted and posted as required by regulation rule 05 05 --

12 months before T (

Or in such a short time that the registrant is required to submit and publish these documents).

Yes. ☒No. ☐If the declaration of arrears is disclosed under S-regulation 405th, please indicate by check markK (Section 229.

This Chapter 405)

As the registrant is aware, it is not included here and will not be included in the final proxy or information statement referenced in Part 3 of this form --

K or any amendments to this form 10K.

☐Indicate by check mark whether the registrant is a large accelerated file manager, a non-accelerated file manager

Or a smaller reporting company.

See the definition of \"large accelerated declarant\", \"accelerated declarant\" and \"small Reporting Company\" in rule 12b2 of the Act.

Largeacceleratedfiler☐Accelerated File☐Non

Speed up filer☐Smallerreporting company☒Indicate whether the registrant is a shell company by check mark (

Defined in Rule 12b-

Securities Trading Act 1934 2).

Yes. ☐No. ☒Total market value of the common stock of the registrant held by non-shareholders, without face value

Related Companies of registrants (

Does not recognize that any of the shares are not included in the determination of such value is a related company)

As of April 30, 2016, according to the NASDAQ Global Market Report of April 30, 2016, the last working day of the company in the most recent second quarter was $13,802,066.

As of December 13, 2016, the company had issued 7,081,034 shares of common stock.

Documents incorporated in the reference section of the company\'s annual report, filed as Exhibit 13.

Report on Form 10 1-

K incorporated by reference in the second part of this table 10

K report: \"Company Information\", \"Management Discussion and Analysis of financial status and results of operations\", \"notes to consolidated financial statements\", Report of Independent CPA firm.

\"In addition, part of the agency statement of the company\'s 2017 annual shareholders meeting is incorporated by reference in part 3 of this form 10.

K report: \"Election of Directors\", \"beneficial ownership of securities\", \"executive compensation\", \"remuneration of directors\", \"compliance with Section 16th (a)

Securities Trading Act of 1934, code of ethics, executive compensation, beneficial ownership of securities, information on equity compensation plans, \"certain relationships and related transactions\", \"independent registration accounting firm and Audit Committee

Approval of audits and permitted non-

Audit services for independent CPA firms.

Cable company Form 10-

KTABLE for CONTENTSPART iitem 1. Business. 3Item1A. Risk Factors. 8Item1B.

The employee\'s opinion was not resolved. 8Item2. Properties. 8Item3.

Legal proceedings. 9Item4.

Information disclosure of mine safety. 9PART IIItem5.

The market for the common equity of the registrant and related shareholder matters. 9Item6.

Select financial data. 10Item7.

Management Discussion and Analysis of Financial Position and operational results. 10Item7A.

Quantitative and qualitative disclosure of market risks. 10Item8.

Financial statements and supplementary information. 10Item9.

Changes and disagreements with accountants in accounting and financial disclosure. 10Item9A.

Control and procedures. 10Item9B.

Other information

Part 3 10.

Directors, executives and corporate governance. 11Item11.

Executive compensation. 12Item12.

Secured ownership of certain beneficial owners and management and related shareholder matters. 12Item13.

Certain relationship and related party transactions, the independence of directors. 12Item14.

Major accounting fees and services. Part ivitem15.

Detailed list of exhibits and financial statements.

13 signatures18part IItem1.

Business View optical cable was established in Virginia in 1983.

Our headquarters is located at 5290, 24019 Avenue, Roanoke, Virginia, and our telephone number is (540)265-0690.

Optical cable company and our wholly owned subsidiary Applied Optical Systems Company(“AOS”)

And center Solutions Co. , Ltd (

\"Center solution \")

With office, manufacturing and warehouse facilities in Roanoke, Virginia, close to Asheville, North Carolina and Dallas, Texas.

Optical Cable Company and its subsidiaries (

\"Company\" or \"OCC\"®\")

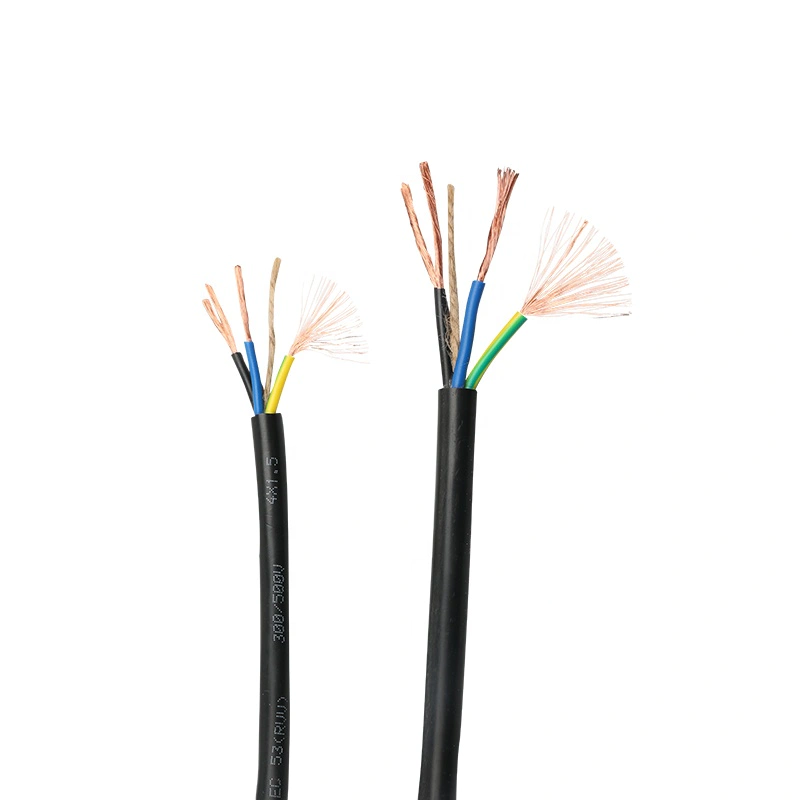

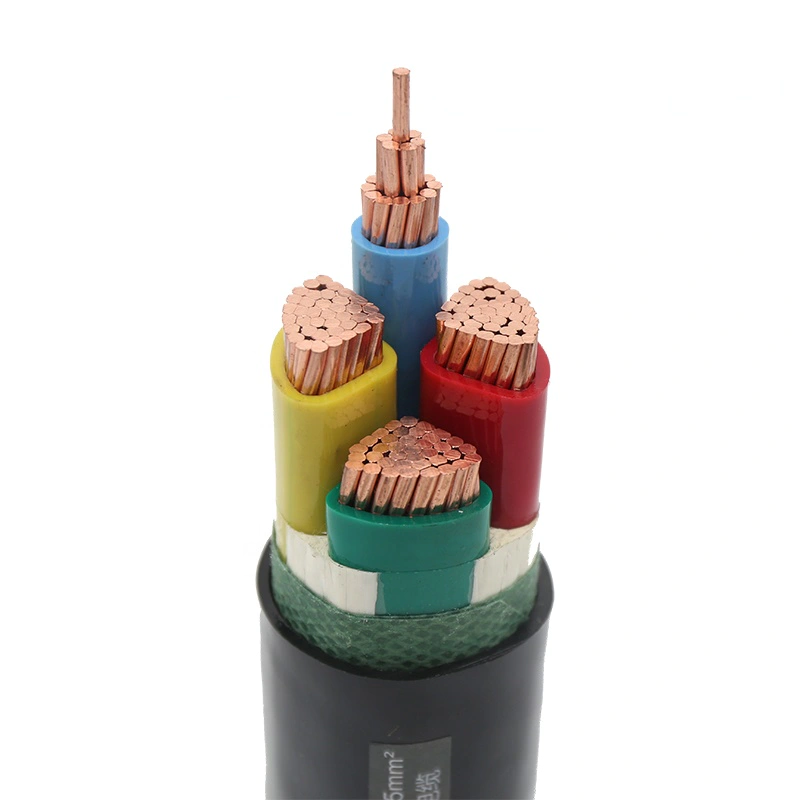

Is a leading manufacturer of optical fiber and copper data communication cabling and connectivity solutions, mainly for the enterprise market and a variety of harsh environments and professional markets (the non-Operator market)

Provide an integration suite of high quality products, run as a system solution, or seamlessly integrate with products from other providers.

OCC also produces and sells products in the wireless carrier market.

OCC\'s products include the use design of customized products from enterprise networks, data centers, residential and campus facilities to special applications and harsh environments (including military, industrial, mining, petrochemical, wireless operators and broadcast applications.

OCC products include fiber and copper, fiber and copper connectors, special fiber and copper connectors, fiber and copper jumpers, pre-

End-to-end fiber and copper cable assemblies, racks, cabinets, data communication enclosures, patch panels, panels, multiple

Media boxes, fiber optic reels and accessories and other cable and connection management accessories designed to meet the most demanding needs of the terminal

Provides a high degree of reliability and superior performance.

The OCC team is looking for first class service

Integrate communication solutions by bundling our products into systems that serve our customers and terminals

Users with integrated cabling and connectivity solutions

Suitable for personal data communication and application needs.

OCC®Is an international recognized pioneer in the design and production of fiber optic cables for the most demanding military applications, as well as fiber optic cables suitable for indoor and outdoor, based on the development of these basic technologies, create a wide range of products.

OCC®It is also an international recognized pioneering and innovative copper connection technology and design to meet the development of copper data communication standards in the industry.

OCC is registered and MIL-in accordance with its ISO 9001: 2008-STD-

790F certified factory is located in Roanoke, Virginia, and its enterprise connection products are mainly located in ISO 9001: 2008 registered factory near Asheville, North Carolina, with ISO 9001: 2008 registered and MIL-harsh environment and professional connectivity productsSTD-

790F certification facilities near Dallas, Texas.

OCC designs, develops and manufactures fiber optic cables for a wide range of enterprises, harsh environments and specialized markets and applications.

We call these products our fiber optic cable products.

OCC designs, develops and manufactures fiber and copper connectivity products for the enterprise market, including a wide range of enterprise and residential applications.

We call these products our enterprise connection products.

OCC is mainly used for military, harsh environments and other special applications, designing, developing and manufacturing a wide range of professional fiber optic connectors and connectivity products.

We call these products our harsh environment and professional connected products.

OCC sells our harsh environment and professional connectivity products in the name of optical cable company and OCC through AOS®With the efforts of our integrated OCC sales team.

Since February 1, 2016, the cable company has increased its ownership of Centric Solutions LLC (

\"Center solution \")to 100%.

Centric Solutions is a company founded in 2008 that provides turnkey cabling and connectivity Solutions for the data center market.

The central solution operates independently of the optical cable company and goes to the market;

However, in some cases, the central solution may provide the product that is offered by the OCC product.

The facility lease for Centric solution expired on November 30, 2015 but was not renewed.

OCC has moved the business of the Center solution to the OCC plant near Dallas, Texas.

Optical Cable Company®South River®Three blades in Nanhe™Advanced Modular Products™SMP Data Communication™Applied Optical System™Focus on solution™And the relevant logo is the trademark of the optical cable company.

Product socc®Is a leading manufacturer of optical fiber and copper data communication cabling and connectivity solutions, mainly for the enterprise market and a variety of harsh environments and professional markets (the non-Operator market)

Provide an integrated set of high-quality, guaranteed products that operate as a system solution or seamlessly integrate with products from other providers.

OCC also produces and sells a large number of products in the wireless carrier market.

OCC\'s products include designs for a variety of uses, from enterprise networks, data centers, residential and campus facilities, to customized products for harsh environments and special applications, including military, industrial, mining wireless operators and broadcast applications.

OCC products include fiber and copper, fiber and copper connectors, special fiber and copper connectors, fiber and copper jumpers, pre-

End-to-end fiber and copper cable assemblies, racks, cabinets, data communication housing, fiber and copper patch panels, panels, multiple

Media boxes, fiber optic reels and accessories and other cable and connection management accessories.

Our products are designed to meet the most demanding needs of the terminal

Provides a high degree of reliability and superior performance.

In the past two years, the OCC has obtained or received license notices for 17 optical fiber and copper connections and patents for innovative design of optical fiber cables.

Our fiber and copper cabling and connectivity products and solutions (

Mainly passive system, not active system)

Used to transmit data, video, radio frequency and voice communication mainly through short timeto moderate-distances.

Fiber optic cable products we design, manufacture, sell and sell a wide range of top products

The first layer of fiber optic cable that provides high bandwidth transmission of data, video and voice communication, mainly through short-to moderate-distances.

OCC is an international recognized pioneer in the design and production of fiber optic cables for the most demanding military applications, as well as fiber optic cables suitable for indoor and outdoor applications, based on the development of these basic technologies, created a wide range of products.

Our product line is diverse and versatile to meet the changing application needs of our customers in the market. Our tight-

The buffer fiber optic cable is mainly aimed at the enterprise market and various harsh environments and professional markets to meet various needs (the non-Operator market)

Including enterprise networks, data centers, residential and campus facilities, as well as the demand for harsh environments and professional markets such as military, industrial, mining, petrochemical and broadcasting applications, to a lesser extent.

OCC also produces and sells a large number of fiber optic cables and hybrid cables (

Fiber and copper)

Products in the wireless operator market.

Our patents.

Buffer fiber unit cable with high fiber-

Calculated and rugged in a compact and lightweight design.

We believe we provide the most comprehensive

Provide buffer optical cable products for our market.

We produce fiber optic cables specially installed, including a variety of hybrid cables (

Fiber and copper)

And cables with special fibers.

In some installations, we can provide additional protection for fiber optic cables.

We offer cables for underground or overhead installations.

For overhead installations, we provide several self-

Supports fiber optic cables, including air Messenger cables with self-function

Supporting construction.

We have a variety of fiber optic cables for flammable grades.

We offer cables that combine different types of fiber and/or copper wire, which are used as a power supply or facilitate the transition from copper wire to fiber --

There is no need to further install the basic system of the fiber optic cable.

Our hybrid cables include a range of safety cables that combine copper power supplies with fiber optic, especially for surveillance cameras and other special applications.

We also design and manufacture special fiber optic cables such as for fiber optic-to-the-Antenna (“FTTA”)

Products for cell tower construction

Military Ground tactics, industry (

Tray cable included)

Mining, deployment of broadcast, oil and gas, festoon, perforated and high density data center applications.

Our products also include fiber optic cables that meet or certify various special application standards, such as: USS.

Minister of DefensePRF-85045/8B and U. K.

Defense Minister of DefenseStan 60-

(3) qualification of military ground tactical optical cable;

Norwegian Classification Society (DNV)

Type Certificate for ship and marine platform applications; U. S.

Mine Safety and Health Administration (MSHA)

Approval for mines;

United States Shipping Bureau (ABS)

Type of cable approved.

We also provide customers with a variety of custom structures to meet their specific communication needs.

Copper data communication cable products we sell a variety of high-quality copper data communication cables, including non-shielded twisted pair (UTP)

And shielded twisted pair (F/UTP)

Riser class, Class 6 and Category 6A performance class, Riser and static pressure box configuration, and structure of various colors.

The addition of copper data communication cables enables the OCC to provide terminal services to our customersto-

Terminal Solution for copper cable network installation.

We design, manufacture, sell and sell innovative top products

Layered fiber and copper connectivity components for a wide range of enterprise, residential, military and harsh environment applications.

Through our innovative technologies, our role in establishing standards for data communication for copper connections has been recognized globally.

The following paragraphs summarize the main types and properties of fiber and copper passive enterprise connectivity products;

However, we also produce many other types of connectivity products: fiber optic connectivity products.

Our fiber optic connectivity products provide customers with comprehensive fiber optic system solutions for computer rooms, telecom cabinets, data centers and workstations, including unique infrastructure and cabling solutions for passive optical LAN (“POL”)installations.

Our products include fiber wall mount, cabinet mount and rack mount housing, pre-

Pre-connected end-to-end fiber case, fiber connector, connector tray, fiber jumper, plug-and-play Box Module

End-to-end fiber optic cable assemblies, adapters, and accessories.

Copper Connection products.

The copper enterprise connectivity products of the OCC provide customers with comprehensive copper system solutions and a range of products that meet component standards, such as computer rooms, telecom cabinets, data centers and workstations, high-speed data and voice

Our products include: patch panel, Jack (

Standard keystone or proprietary baffle configuration)

, Plug, jumper, panel, surface mounted box, distribution and more

Media box, copper rack mounting and wall-mounted housing, cable assembly, cable organizer and other cabling products.

OCC provides products that meet 6A, 6 and 5e standards in shielded and non-shielded products, as well as industry-recognized class 8 test qualified fixtures and class 8 plugs.

OCC pioneered the technology required for Ethernet high-performance twisted pair cabling and RJ45 connection applications, with a number of patents for electrical performance and availability capabilities.

Cabinets, racks and enclosures.

We offer a variety of high

Performance networks, data storage, and telecom management systems for businesses and homes.

Our product line includes data cabinets, wall-mounted chassis, horizontal and vertical cable management systems, and open frame relay racks.

These products meet the needs of each network segment.

Our products serve equipment, cross-cutting

Connection and terminal requirements for copper and fiber multi-port

Media applications for passive optical LAN and ceiling mounting enclosures listed by UL for wall-mounted and space-saving.

Residential products.

Our products include a comprehensive range of data communication cabling products that are made up of a wide range of enclosures, modules and modular sockets designed specifically for individual residences and multiple residences.

By using our products, customers can get a convenient way to build networks in the home, customize, distribute and manage services including voice, data, video, audio and security.

Harsh environments and professional connectivity products we design, manufacture, and sell special fiber optic connectors and connectivity components, certain rugged Copper data communication connectors, and related deployment systems and solutions for the military, other harsh environments and special applications.

For deployed applications, we produce a full range of tactical fiber optic connectors that meet US standards. S.

Standards of the Ministry of Defense, such:PRF-29504, MIL-DTL-83522, MIL-DTL-

83526, NAVSEA 7379171, NAVSEA 7379172.

In addition to military designated products, we also produce EZ-MATE™, MHC®-II, MHC®-III and F-LINK™.

Many of our products feature a gender design that allows tandem assembly without considering the gender of the connector.

This design allows for rapid and easy deployment and retrieval.

To provide a more comprehensive interconnect solution, we have designed and developed a complete range of lightweight reels and accessories.

Our patented light reel and patent-pending light reel holder are approved for use by the US military.

We produce cylindrical connector products for fixed fiber, or applications where fiber and copper connections are required in the same connector.

We have made all kinds of single, duplex and multi-workers.

Channel fiber optic assemblies for mining, oil and gas, petrochemicals, broadcasting, industrial and military applications.

Our products also include rugged RJ45 connectors.

Distribution of products and services our products are sold to major distributors, regional distributors, various professional and small distributors, OEMs, value-

Increased dealers, in some cases, eventuallyusers.

In general, our products are purchased by contractors, system integrators, and end customersusers.

Competitive business conditions, industry status and competitive methods optical fiber and copper data communication cables and connecting enterprise markets and other short-term marketsto moderate-

Competition in the remote market is fierce.

Our cable product line competes with products from large cable manufacturers such as Corning, General Cable, and Belden, Nexans S. A. (including Berk-Tek)

CommScope Holdings Limited, OFS, AFL (

Subsidiary of Fujikura)

Some are made of fiber.

Our copper cable product line competes with products from large copper cable manufacturers such as General Cable. , Belden Inc. , Nexans S. A. (including Berk-Tek)

CommScope Holdings Limitedand others.

Our fiber and copper connectivity product line competes with products from large fiber and copper connectivity manufacturers such as CommScope Holdings

, Corning company, Leverton, leglang S. A. (

Including ortrooper)

Panduit and others

Our harsh environment and professional connectivity product line competes with Amphenol Corporation\'s products (including AFSI)

Delphi and others.

Some of our competitors are more mature than us and benefit from greater market recognition with much larger financial, R & D, production and marketing resources than we do.

Competition may intensify if new companies enter the market or existing competitors expand their product lines.

Compliance with environmental law we do not know that our facilities violate environmental law anywhere, state or federal.

In our fiscal 2016, we have not incurred any significant expenditures related to environmental compliance.

We believe that we have complied materially with all applicable environmental regulations.

R & D costs for R & D activities totaled $1. 3 million, $1.

$3 million and $1.

The financial year ended October 31, 2016 was 4 million, 2015 and 2014 respectively.

Our research and development costs are related to a variety of research projects related to our enterprise connectivity product line, including but not limited to category 8 product development.

Product development work related to our fiber optic cable products and our harsh environment and professional connection products is usually related to product improvement and customer product development requests, it is characterized by General and administrative expenses of goods allocated to cost sales and sales, not by R & D expenses.

Customer and terminal

Users we have a global customer base and sold in more than 50 countries in the fiscal year 2016.

Our products are sold to major dealers, regional distributors, various professional and small distributors, original equipment manufacturers, value-

Increased dealers, in some cases, eventuallyusers.

In general, our products are purchased by contractors, system integrators, and end customersusers.

Here is a partial list of representative types of end-

Users of our fiber and copper cable connections and cable products: commercial establishments.

Businesses located in offices, retail spaces and medical facilities are installing or improving networks to distribute more and more data.

These services often use high-performance Local area networks (“LANs”)or datacenters.

Government agencies.

Government agencies often have large buildings or buildings, and many people need to access and process a lot of data.

Like business organizations, these usually include high-performance LAN or data centers.

Our cabling and connectivity solutions are a reasonable choice, so security may also be required.

Industrial and manufacturing facilities.

The environment for industrial and manufacturing facilities is usually worse (

Heavy use of electrical equipment)

Than other types of enterprises.

In these environments, our fiber optic cables and connectivity products are robust, resistant to electrical noise, high information carrying capacity, and greater distance capabilities.

These facilities are also needed for our copper cabling and connectivity products.

Our products are installed in automotive assembly plants, steel plants, chemical and pharmaceutical facilities, petrochemical facilities and refineries, mines and other similar environments.

Cable Assembly plant.

Cable assemblies are usually manufactured with short cable assemblies

Connect with the connector.

These manufacturers support almost all areas of the market, consuming a lot of cable and connecting products.

Products sold to customers in this market may sometimes be labeled as private. Military.

Our core fiber optic cable technology enables us to develop and efficiently produce fiber optic cables for military tactical applications that survive in extreme mechanical and environmental conditions.

We are certified by the US Department of Defense (“U. S. DoD”)

As a qualified supplier of ground tactical optical cables.

Our Roanoke and Dallas manufacturing plants are also certified in the United States. S. DoD as MIL-STD-

790F facility, one of the most respected certifications in the defense industry.

We also offer American products. S.

The MoD has tactical fiber optic cable assemblies and we sell qualified fiber optic cables connected by military connectors on military reels and reels ready for deployment.

Educational institutions.

To increase the speed of data transmission, colleges, universities, high schools and primary schools are installing and improving their networks and using data communication solutions to support interactive learning systems.

Wireless operators.

We design and manufacture all kinds of special optical fiber and mixing (

Fiber and copper)

Cable for FTTA applications such as mobile tower construction-

And upgrade.

Original equipment manufacturer.

We have privately marked some of our copper connection products for other major copper connection manufacturers, including major competitors.

We have a broad technical base and diverse manufacturing processes that meet the needs of different customers.

The total number of employees in October 31, 2016 was 331 (

(Excluding independent sales representative and company).

None of our employees have union representation.

We have not encountered a shutdown and we continue to take what we see as appropriate to ensure that our employees are in good relations. Item1A.

Risk factor 1A.

\"Smaller reporting companies\" defined in Rule 12b do not require risk factors

2 promulgated in accordance with the revised Securities Trading Act of 1934.

Some risk factors that may affect the company, the company\'s future operating performance and future financial situation, and the future market valuation of the company are mentioned \"forward\"

Search for information \", including management\'s discussion and analysis of the financial position and operational results in the company\'s annual report for the financial year ended October 31, 2016 (

File as attachment 13.

Report on Form 10 1-K)

In our Quarterly Report on Form 10Q. Item1B.

Unresolved employee reviews. Item2.

We have facilities located in Roanoke County, Virginia, and the land where Roanoke facilities are located.

Our Roanoke factory mainly provides services for our company headquarters, fiber optic cable manufacturing business, fiber optic cable product development function and fiber optic cable warehouse.

Our Roanoke factory is located on about 23 acres near Roanoke, Virginia airport and major trucking company facilities.

The building area of our Roanoke facility is approximately 146,000 square feet.

We have our facilities near Asheville, North Carolina (

Swannanoa in North Carolina)

And the land where our Asheville facilities are located.

Our Asheville factory mainly owns the administrative office, the enterprise connection manufacturing operation, the enterprise connection product development function and the enterprise connection warehouse.

Our Asheville factory is located on about 13 acres east of Asheville, North Carolina.

The Asheville facilities include two buildings with a total area of about 64,000 square feet.

We rent our facilities near Dallas, Texas (PLANO, Texas).

Our Dallas factory mainly has administrative office, harsh environment and professional connection manufacturing operation, harsh environment and professional connection product development function as well as harsh environment and professional connection warehouse.

Our facilities in Dallas are located in the industrial complex of suites.

The rental area is approximately 34,000 square feet.

We rented a warehouse in Roanoke, Virginia.

The leased space is approximately 36,000 square feet and is mainly used to store raw materials related to our fiber optic cable products.

In our view, during the fiscal year 2016, our collective manufacturing facilities currently operate an average of about 50% of the capacity of production equipment.

Since the various production equipment is specialized, our product portfolio is also different, in any given time, the individual manufacturing equipment may be at a higher or lower production capacity at different times.

Additional personnel are required to be hired and trained, additional storage space may be required, and depending on the product mix, certain additional production equipment may be required to take advantage of the excess production equipment capacity of all our facilities.

We cannot guarantee the time required to complete the recruitment and training of personnel or the process of purchasing and installing certain additional production equipment or our ability to obtain additional storage space, it is necessary to take advantage of our excess production capacity.

The facility lease for Centric solution expired on November 30, 2015 but was not renewed.

The OCC has moved the business of the Center solution to the existing facilities of the OCC near Dallas, Texas. Item3.

G. , May 31, 2016.

Thomas Hazleton Jr.

Terminated by Applied Optical Systems

A wholly owned subsidiary of OCC (“AOS”)

The reasons defined in his employment agreement in October 31, 2009 (

Employment Agreement)

In addition, in the stock purchase agreement signed by OCC as buyer and G. on October 31, 2009

Thomas Hazleton Jr. (“Hazelton”)

Daniel rolls (“Roehrs”), as sellers (Exhibit 10.

Table 10 Company Annual Report 22-

The deadline for October 31, 2009 is January 29, 2010)(the “SPA”).

OCC acquired AOS from Hazelton and Roehrs under SPA terms.

In addition to the claims made under the employment agreement, the OCC also filed a claim against Hazelton under the SPA in relation to Hazelton and Roehrs\'s alleged illegal acts.

Therefore, the OCC does not pay any severance pay for Hazelton and does not intend to pay any minimum income for Hazelton (

According to SPA terms, the maximum amount payable in January 31, 2017 is $470,665)

Otherwise, it would be owed to Hazelton, but Hazelton terminated for reasons and the OCC made a claim for compensation under the SPA.

Due to this dispute, OCC and AOS filed a lawsuit against Hazelton in a state court in Roanoke, Virginia, on September 9, 2016.

Hazelton filed a lawsuit against OCC and AOS in Colin County court, Texas, on September 7, 2016.

In addition, OCC, AOS and Centric Solutions LLC, a wholly owned subsidiary of OCC (

\"Center solution \")

A lawsuit has been filed against William Di Bella Rohe (“DiBella”)(

Former staff of center Solutions)

And Rosenberg CDS, LLC and Rosenberg North America (

\"Rosenberg \")

On September 20, 2016, in the state court in Roanoke County, Virginia, related illegal acts involving Roch rs, Di Bella and Rosenberg.

At this point, the OCC does not believe that these disputes or the resulting litigation will have a significant adverse effect on the OCC.

From time to time, we deal with various other claims, legal actions and regulatory reviews that arise in the normal course of business.

The management believes that the final disposition of these matters will not have a significant adverse effect on our financial position, operating results or liquidity. Item4.

Mine safety disclosure is not applicable. PART IIItem5.

Registrant common stock and related shareholder equity market information related to beneficial ownership of securities of shareholders with more than 5% of the Company\'s common stock and management, this is listed under the title \"beneficial ownership of securities\" in the agency statement of the company\'s 2017 annual shareholders meeting, incorporated into this article by reference.

As of October 31, 2016, the company had issued and outstanding 7,081,159 shares of common stock.

The company has at least 36 employees and board members.

6% of outstanding and outstanding shares as of October 31, 2016, including shares that are still likely to be confiscated under attribution requirements.

There are plans for issuers to purchase equity securities companies (

\"Repurchase plan \")

On July 14, 2015, with the approval of the board of directors, the shares purchased and withdrawn from the Company\'s common stock amounted to 400,000 shares, about 6 shares.

0% of the shares were subsequently issued.

The company is expected to complete the purchase within 24 hoursto 36-

The monthly period, but there is no clear period for repurchase. For the three-

For the one-month period ended October 31, 2016, the company did not repurchase and withdraw any outstanding shares of common stock under the scheme, and under the repurchase scheme, 398,400 shares remained to be purchased.

The company bought back outstanding common shares directly from certain shareholders through a strange bulk repurchase offer outside the repurchase plan.

In the fiscal year 2016, OCC bought back and withdrew a total of 14,225 shares at $40,150 outside the repurchase plan.

The information contained in Annex 13 is the information under the heading \"company information\" of our annual report for the fiscal year ended October 31, 2016.

Report on Form 10 1-

K, incorporated into this article by reference. Item6.

Selected Financial Data required for \"smaller reporting companies\" as defined in Rule 12b

2 promulgated in accordance with the revised Securities Trading Act of 1934. Item7.

Management\'s Discussion and Analysis of Financial Position and operational results the information contained under the heading \"Management\'s Discussion and Analysis of Financial Position and operational results\" of our fiscal year report as of October 31, 2016, file as attachment 13.

Report on Form 10 1-

K, incorporated into this article by reference. Item7A.

Quantitative and qualitative disclosure of market risks we do not engage in transactions in derivative financial instruments or derivative instruments.

As of October 31, 2016, due to interest rate risk, foreign currency exchange risk, commodity price risk or stock price risk, our financial instruments do not face significant market risks. Item8.

The title of the financial statements and supplementary data \"Consolidated Financial Statements\", information under \"Notes to Consolidated Financial Statements\", \"and\" reports of independent certified public accountants \", submitted as Annex 13, this is our financial year report as of October 31, 2016.

Report on Form 10 1-

K, incorporated into this article by reference. Item9.

Changes and disagreements with accountants in accounting and financial disclosure the company changed the principal accountants for the fiscal year ended October 31, 2016 from KPMG to Brown, EdwardsL. P.

As of October 31, 2015 or any prior fiscal year, there is no disagreement with our former accountant.

The change of the company\'s main accountant is approved by the Audit Committee of the company\'s board of directors.

In the fiscal year ended October 31, 2016, we have no disagreement with the current accountant regarding any accounting matters or financial disclosure. Item9A.

Controls and Procedures disclosure controls and procedures.

The company maintains disclosure control and procedures (

Defined in Rule 13a-15(e)and 15d-15(e)

Under the revised Securities Trading Act of 1934 (

Trade Act))

Designed to effectively guarantee that information disclosed in the report is recorded in accordance with the requirements of the Transaction Act, processed, aggregated and reported within the time specified in the Securities and Exchange Commission rules and forms (the “SEC”)

, And accumulate and communicate this information to management in order to make a timely decision on the required disclosure.

In designing and evaluating disclosure controls and procedures, management recognizes that any control and procedures, regardless of how well designed and operated, can only provide reasonable assurance to achieve the desired control objectives, management needs to apply its judgment when evaluating costs

Possible control and procedural interests.

Due to the inherent limitations of all control systems, any assessment of control cannot be absolutely guaranteed that all control issues and fraud incidents, if any, will be identified.

These inherent limitations include that the judgment in the decision may be wrong and that the fault may occur due to simple errors or errors.

The design part of any control system is based on certain assumptions about the possibility of future events, and no design can guarantee the successful achievement of its established goals in all potential future conditions.

As of October 31, 2016, the company completed an assessment with the supervision and participation of management, including the chief executive officer and the chief financial officer (

Major accounting and major financial personnel)

We disclose the effectiveness of the design and operation of controls and procedures.

Based on this assessment, the chief executive officer and the chief financial officer concluded that the company\'s disclosure controls and procedures came into effect on October 31, 2016.

Annual report of management on internal control of financial reports.

The management of the company is responsible for establishing and maintaining adequate internal control over financial reporting (

Defined in Rule 13a-15(f)or 15d-15(f)

Under the transaction act).

Internal control of financial reports is a process designed to provide reasonable assurance for the reliability of financial reports and for the preparation and fair presentation of financial statements for external purposes in accordance with US regulationsS.

Generally accepted accounting principles, including the following policies and procedures :(i)

Involving the maintenance of records that reasonably, in detail, accurately and fairly reflect the transaction and disposal of the company\'s assets; (ii)

Provide reasonable assurance that the necessary transactions are recorded in accordance with recognized accounting principles to allow the preparation of financial statements, and that income and expenses are made only in accordance with the authorization of our management and directors of the company; and (iii)

Provide reasonable assurance to prevent or timely discover unauthorized acquisition, use or disposal of company assets that may have a significant impact on the financial statements.

Due to the inherent limitations of financial reporting, internal controls may not be able to prevent or detect misstatements.

Therefore, even if the financial report is effectively controlled internally, it can only provide reasonable guarantee for the preparation of the financial statements.

In addition, as of the specific date, the effectiveness of the internal control of the financial report has been assessed, and the continued effectiveness of the future period is affected by the following risks: due to changes in conditions, the control may become inadequate, or the degree of compliance with policies and procedures may decline.

The design and effectiveness of the evaluation of the company\'s financial reporting internal control system on the basis of the October 31, 2016 deadline framework, proposed \"internal control-

The comprehensive framework issued by the Committee of Sponsoring Organizations of the Treadway committee on 2013.

On the basis of the assessment, management concluded that the company\'s internal control over financial reporting was effective as of October 31, 2016.

Changes in internal control of financial reporting.

In the fourth quarter of the fiscal year covered in this report, the company\'s internal control of the financial report has not had a significant impact or is likely to have a significant impact, and our internal control of the financial report. Item9B.

No other information. PARTIIIItem10.

For information about the registrant directors, please see \"election of directors\", \"directors\", \"and\" executives \"in the agency statement of the company\'s 2017 annual meeting of shareholders, this information is incorporated into this article by reference.

For information about the registrant\'s executive officer, please refer to the \"executive officer\" in the agency statement of the company\'s 2017 annual shareholders meeting, which is incorporated into this article by reference.

Information on compliance with Section 16 (a)

The Securities Trading Act of 1934, in which the title \"complies with Section 16 (a)

The Securities Exchange Act of 1934 was incorporated into this agreement by reference in the agency statement of the company\'s 2017 annual shareholders meeting.

Information on the corporate code of ethics applicable to the company\'s chief executive officer and company senior finance officer required by this project is the title \"ethics\" consolidated by reference to the company\'s agency statement. ”Item11.

The information listed under the heading \"executive compensation\" and \"director compensation\" in the agency statement of the 2017 annual shareholders\' meeting of executive compensation company is incorporated into this agreement by reference. Item12.

Security ownership of certain beneficial owners and management and information Plan categories of relevant shareholder equity compensation plans (a)

The number of securities issued when exercising outstanding options, warrants and rights (1)(b)Weighted-

Average exercise price of outstanding options, warrants and rights (c)

According to the equity compensation plan, the number of securities that can be issued in the future (

Excluding securities reflected in the column (a))

Equity Compensation Plan: The second revision and restatement of the 2011 Equity Incentive Plan1)

Including restricted shares issued and not issued but not yet owned and confiscated.

The term \"shares\" in the table above refers to our common stock.

Information on directors, executives and shareholders having more than 5% of the Company\'s common stock beneficial rights and interests, which is proposed under the title \"beneficial ownership of securities\" in the agency statement of the company\'s 2017 annual shareholders\' meeting, registered here by reference.

According to Item201, information on securities authorized to be issued under the equity compensation plan required by this project (d)

Supervision S-

K, was established with reference to the company\'s proxy statement under the heading \"equity compensation plan information. ”Item13.

Certain relationships and related transactions, information that the director is independent of certain transactions with the management of the company, this is listed under the heading \"certain relationships and related transactions\" in the agency statement of the company\'s 2017 annual shareholders meeting, incorporated into this article by reference. Item14.

The principal accountant fees and services information about certain principal accountant fees and services, listed under the title \"independent CPA firm\" in the agency statement of the company\'s 2017 annual shareholders meeting, registered here by reference.

Information about pre-

Audit and non-audit approval policies

The audit services required for this project are based on the company\'s pre-audit committee

Approval of audits and permitted non-

Audit services for independent CPA firms. ”PART IVItem15.

List of exhibitors and financial statements. (a)

List of documents submitted as part of this report: 1.

Financial statements: the consolidated financial statements of the company and their associated notes are hereby incorporated with reference to pages 24 to 48 of the company\'s annual report submitted in Annex 13.

Form 10-1K. 2.

Schedule of financial statements: Since the required information does not apply or the information appears in the consolidated financial statements or related notes, all schedules are omitted. 3.

Exhibits in Form 10-

K under S-regulation 601st

K as follows: Exhibition number. Description3.

1 Amendment to the Amended and Restated Articles of Association submitted on November 5, 2001 as amended to November 5, 2001 (

Refer to Annex 1 of company form 8 for incorporation into the company-

A12G submitted to the Commission on November 5, 2001). 3.

2 Amendments to the Amended and Restated Articles of Association submitted on July 5, 2002 as amended to July 5, 2002 (

Registered here by reference to Appendix A of the company\'s final agency Statement on Form 14A submitted on July 5, 2002). 3.

3 Revision and restatement of the articles of association of optical cable company (

Refer to Annex 3 for inclusion in this document.

2 to the Company\'s Quarterly Report Form 10-

Q for the third quarter as of July 31, 2011). 4.

1 certificate form representing common stock (

Refer to Annex 4 for inclusion in this document.

1 to company Quarterly Report Form 10-

Q for the third quarter as of July 31, 2004 (file number 0-27022)). 4.

2 Forms of certificate representing common stock (

Refer to Annex 4 for inclusion in this document.

2 to the Company\'s Quarterly Report Form 10-

Q for the third quarter as of July 31, 2012). 4.

3 The Equity Protection Agreement between the optical cable company and the US share transfer trust company acting as the right agent as of October 28, 2011, including the certificate of rights and the form of the exercise of the election (

Refer to Annex 4 for inclusion in this document.

1 to company form 8-

A12G submitted to the Commission on November 1, 2011). 4.

4 optical cable company and advanced modular products registered as borrowers, as well as the credit agreement signed by Bank of the valley as a lender dated May 30, 2008, in the amount of $17,000,000, including a revolver of $6,000,000;

Term Loan A for $2,240,000;

Regular loan B for $6,500,000;

And a capital acquisition term loan of $2,260,000 (

Refer to Annex 4 for inclusion in this document.

16 Company Annual Report Form 10-

The deadline for October 31, 2008 is January 29, 2009). 4.

5 on May 30, 2008, the credit line trust contract between the optical cable company as the guarantor, lakelarian as the trustee and the Valley Bank as the beneficiary (

Refer to Annex 4 for inclusion in this document.

17 Company Annual Report Form 10-

The deadline for October 31, 2008 is January 29, 2009). 4.

6 on May 30, 2008, the senior modular products registered as the insured, the trust deed, the guarantee agreement and the fixed device filing between lakelian and the Valley Bank as the beneficiary (

Refer to Annex 4 for inclusion in this document.

Company Annual Report 18 Forms 10-

The deadline for October 31, 2008 is January 29, 2009). 4.

7 Safety Agreement between optical cable company and advanced modular products company and Valley Bank in May 30, 2008 (

Refer to Annex 4 for inclusion in this document.

Table 10 Company Annual Report 19-

The deadline for October 31, 2008 is January 29, 2009). 4.

8 fixed-term loans May 30, 2008 Notes of $2,240,000 for optical cable companies and advanced modular products companies (

Refer to Annex 4 for inclusion in this document.

Table 10 Company Annual Report 21-

The deadline for October 31, 2008 is January 29, 2009). 4.

9 The fixed-term loan B note amount of cable company and advanced modular products company in May 30, 2008 was US $6,500,000 (

Refer to Annex 4 for inclusion in this document.

Table 10 Company Annual Report 22-

The deadline for October 31, 2008 is January 29, 2009). 4.

10 The first loan amendment agreement signed by cable company and Valley Bank on February 16, 2010 (

Refer to Annex 4 for inclusion in this document.

Company Current Report on Form 8-

K submitted on February 22, 2010). 4.

11 The second loan amendment agreement between the optical cable company and it in April 30, 2010, which itself and the successor to the merger as a senior modular product company and Valley Bank (

Refer to Annex 4 for inclusion in this document.

13 to the Company\'s Quarterly Report Form 10-

Q submission for the quarter ended April 30, 2010 June 14, 2010). 4.

12 cable company and SunTrust Bank Appendix A of commercial notes dated April 30, 2010 (

Refer to Annex 4 for inclusion in this document.

14 to the Company\'s Quarterly Report Form 10-

Q submission for the quarter ended April 30, 2010 June 14, 2010). 4.

13 The third loan amendment agreement between the optical cable company and it in April 22, 2011, as the successor to the merger of the senior modular products company and the Valley Bank (

Refer to Annex 10 for inclusion in this document.

Company Current Report on Form 8-

Date: April 28, 2011. 4.

The fourth loan amendment agreement between the optical cable company and it in July 25, 2011, as the successor to the merger of the senior modular products company and the Valley Bank (

Refer to Annex 99 for inclusion in this document.

Company Current Report on Form 8 2-

Date: July 26, 2011. 4.

15 in August 31, 2012, the fifth loan amendment agreement between the optical cable company and it, as the successor to the merger of the senior modular products company and the Valley Bank (

Refer to Annex 4 for inclusion in this document.

Company Current Report on Form 8-

Date: August 31, 2012. 4.

16 commercial notes of cable company and SunTrust Bank on August 30, 2013, with a principal of US $9,000,000 (

Refer to Annex 99 for inclusion in this document.

Company Current Report on Form 8-

Date: September 3, 2013. 4.

17 commercial bill agreement signed by optical cable company and SunTrust Bank on August 30, 2013 (

Refer to Annex 99 for inclusion in this document.

Company Current Report on Form 8 2-

Date: September 3, 2013. 4.

18 cable company and SunTrust Bank Appendix A of commercial notes dated August 30, 2013 (

Refer to Annex 99 for inclusion in this document.

Company Current Report on Form 8-

Date: September 3, 2013. 4.

19 in August 30, 2013, the cable company and its sixth loan amendment agreement between them were the heirs to the merger of the senior modular products company and the Valley Bank (

Refer to Annex 99 for inclusion in this document.

Company Current Report on Form 8-

Date: September 3, 2013. 4.

20 binding renewal letter issued by optical cable company and SunTrust Bank on August 11, 2014 (

Refer to Annex 10 for inclusion in this document.

Company Current Report on Form 8-

Date: August 11, 2014. 4.

21 binding renewal letter issued by optical cable company and SunTrust Bank on May 7, 2015 (

Refer to Annex 10 for inclusion in this document.

Company Current Report on Form 8-

Date: May 8, 2015. 4.

22 Am Optical Cable Co. , Ltd. took SunTrust Bank on May 7, 2015 (

Refer to Annex 10 for inclusion in this document.

Company Current Report on Form 8 2-

Date: May 8, 2015. 4.

23 on January 25, 2016, the optical cable company merged itself with the successor as a senior modular product company, as well as the successor to the interests of the Valley Bank, BNC Bancorp (

Refer to Annex 4 for inclusion in this document.

Table 10 company annual report 23-

The deadline for October 31, 2015 is January 28, 2016). 4.

24 cable company and SunTrust Bank amendments to the commercial and commercial bill agreement of January 25, 2016 (

Refer to Annex 4 for inclusion in this document.

Table 10 company annual report 24-

The deadline for October 31, 2015 is January 28, 2016). 4.

On January 25, 25. 2016, the optical cable company revised and reiterated the second security agreement for SunTrust Bank, its current and future affiliates and their successors and assigns (

Refer to Annex 4 for inclusion in this document.

Table 10 Company Annual Report 25-

The deadline for October 31, 2015 is January 28, 2016). 4.

In April 26, 26. 2016, as a borrower, optical cable company signed a credit agreement with Bank of North Carolina as a lender amounting to $7,000,000 (

Refer to Annex 4 for inclusion in this document.

Company Current Report on Form 8-

K/A submitted on May 3, 2016). 4.

The amount of circular credit bills for cable companies in April 26, 2016 was $7,000,000 (

Refer to Annex 4 for inclusion in this document.

Company Current Report on Form 8 2-

K/A submitted on May 3, 2016). 4.

28 notes with a fixed-term loan of $1,816,609.

Optical Cable Company in April 26, 2016 (

Refer to Annex 4 for inclusion in this document.

Company Current Report on Form 8-

K/A submitted on May 3, 2016). 4.

29 note B on a fixed-term loan in the amount of $5,271,410.

83. (April 26, 2016)

Refer to Annex 4 for inclusion in this document.

Company Current Report on Form 8-

K/A submitted on May 3, 2016). 4.

30 modification of the credit line trust contract between the optical cable company and its April 26, 2016 (

Merge through subsequent Superior Modular products of merger)

Andrew B. as a guarantorAgee (

Replace Lakey Ryan)

As trustee and Bank of North Carolina (

Successor to merger with Valley Bank)

As a beneficiary, amend the trust deed for certain credit lines of May 30, 2008 (

Refer to Annex 4 for inclusion in this document.

Company Current Report on Form 8 5-

K/A submitted on May 3, 2016). 4.

31 optical cable company and its April 26, 2016 trust deed, modification of guarantee agreement and transfer of lease and rent (

Merge through subsequent Superior Modular products of merger)

Andrew B. as a guarantorAgee (

Replace Lakey Ryan)

As trustee and Bank of North Carolina (

Successor to merger with Valley Bank)

As a beneficiary, certain trust covenants, guarantee agreements and lease and rent transfers dated May 30, 2008 (

Refer to Annex 4 for inclusion in this document.

6 to the current report of the company 8-

K/A submitted on May 3, 2016). 4.

32 Cable Company and Bank of North Carolina security agreement of April 26, 2016 (

Refer to Annex 4 for inclusion in this document.

7 to the Company\'s Current Report 8-

K/A submitted on May 3, 2016). 10.

1*2005 equity incentive plan of Optical Cable Corporation (

Refer to Appendix A of the final agency Statement on Form 14A submitted by the company on February 23, 2005). 10.

2*2011 Equity Incentive Plan of Optical Cable Corporation (

Refer to Appendix A of the final agency Statement on Form 14A submitted by the company on February 23, 2011). 10.

3 * optical cable company modifies and restates the 2011 Equity Incentive Plan (

Refer to Appendix A of the final agency Statement on Form 14A submitted by the company on February 27, 2013). 10.

4 * The second revision and restatement of the 2011 Equity Incentive Plan of the optical cable company (

Refer to Appendix A of the final agency Statement on Form 14A submitted by the company on March 4, 2015). 10.

5*2005 equity incentive plan, 2011 Equity Incentive Plan and 2011 Equity Incentive Plan of optical cable company (

Refer to Annex 10 for inclusion in this document.

12-company Quarterly Report Form 10-

Q. deadline as of April 30, 2006 (submitted on June 14, 2006). 10.

6 * Business Performance Table (

Measurement of company Financial performance)

Optical Cable Company\'s 2005 equity incentive plan, 2011 Equity Incentive Plan and the revision and restatement of the 2011 Equity Incentive Plan (

Refer to Annex 10 for inclusion.

Table 10 company quarterly report 20-

Q. deadline as of April 30, 2009 (submitted on June 12, 2009). 10.

7 Notice of the company exercising the warrants to purchase 98,741 shares of common stock of Applied Optical Systems Co. , Ltd.

Date October 30, 2009 (

Refer to Annex 10 for inclusion in this document.

Table 10 Company Annual Report 21-

The deadline for October 31, 2009 is January 29, 2010). 10.

8 as stock purchase agreement of October 31, 2009 between buyer and G. Company

Thomas Hazleton Jr.

Daniel Roehrs as seller (

Refer to Annex 10 for inclusion in this document.

Table 10 Company Annual Report 22-

The deadline for October 31, 2009 is January 29, 2010). 10. 9Buy-

Sales Agreement before and between G. , October 31, 2009

Thomas Hazleton Jr.

As a guarantor, the company (

Refer to Annex 10 for inclusion in this document.

Table 10 Company Annual Report 25-

The deadline for October 31, 2009 is January 29, 2010). 10.

10 compensation agreement between the company and the applied optical system company in October 31, 2009(

Refer to Annex 10 for inclusion in this document.

Table 10-Company Annual Report 27-

The deadline for October 31, 2009 is January 29, 2010). 10.

11 October 31, 2009, as a buyer, supplementary agreement between the application optical systems company and the company, George T.

New campus Family Trust, G.

Thomas Hazleton Jr.

And Daniel Luo (

Refer to Annex 10 for inclusion in this document.

Table 10 on the Company\'s Annual Report 28-

The deadline for October 31, 2009 is January 29, 2010). 10.

12 application Optical Systems Corporation and its termination agreement of October 31, 2009

Companies and G as lenders.

Thomas Hazleton Jr.

Daniel rolls (

Refer to Annex 10 for inclusion in this document.

Table 10 company annual report 29-

The deadline for October 31, 2009 is January 29, 2010). 10.

13 agreement on the exercise of authorization between the company and the company for the application of optical systems

Date October 30, 2009 (

Refer to Annex 10 for inclusion in this document.

Table 10 company annual report 30-

The deadline for October 31, 2009 is January 29, 2010). 10.

14 redemption agreement between cable company and BB & T Capital Market in July 14, 2015 (

Refer to Annex 10 for inclusion in this document.

Company Current Report on Form 8-

K submitted on July 14, 2015). 10.

15 * revised and restated employment agreement by cable company and Neil D. Wilkin, Jr.

Effective April 11, 2011 (

Refer to Annex 10 for inclusion in this document.

Company Current Report on Form 8 2-

K submitted on April 15, 2011). 10.

16 * amendment, effective December 18, 2012, to amend and reaffirm the employment agreement between the cable company and Neil D. Wilkin, Jr.

Effective April 11, 2011 (

Refer to Annex 10 for inclusion in this document.

16 company Quarterly Report Form 10-

Q. deadline as of January 31, 2013 (submitted on March 15, 2013). 10.

17 * The Second Amendment to the revised and restated employment agreement between optical cable company and Neil D, effective March 14, 2014Wilkin, Jr.

Effective on April 11, 2011 and revised on December 18, 2012 (

Refer to Annex 10 for inclusion in this document.

Table 10 quarterly report of companies 19-

Q. deadline as of January 31, 2014 (submitted on March 17, 2014). 10.

18 * revised and restated employment agreement by optical cable company and Tracy G.

Smith came into effect on April 11, 2011 (

Refer to Annex 10 for inclusion in this document.

Company Current Report on Form 8-

K submitted on April 15, 2011). 10.

19 * since December 18, 2012, amendments to the employment agreement have been revised and restated between the optical cable company and Tracy G.

Smith came into effect on April 11, 2011 (

Refer to Annex 10 for inclusion in this document.

Company quarterly report 18 Table 10-

Q. deadline as of January 31, 2013 (submitted on March 15, 2013). 10.

20 * Second Amendment to amend and restate the employment agreement between optical cable company and Tracy G. , effective March 14, 2014

Smith came into effect on April 11, 2011, as amended on December 18, 2012 (

Refer to Annex 10 for inclusion in this document.

Table 10 company quarterly report 22-

Q. deadline as of January 31, 2014 (submitted on March 17, 2014). 11.

1 Statement on the calculation of earnings per share (

Refer to Note 14 to the consolidated financial statements contained herein). 13. 1Annual Report. FILED HEREWITH. 21.

List of 1 subsidiaries. FILED HEREWITH. 23.

1 consent of an independent CPA firm. FILED HEREWITH. 23.

The KPMG law firm agreed. FILED HEREWITH. 31.

1 Certification of the company\'s chief executive under section 302nd of the Sabans act

The Oakley Act of 2002. FILED HEREWITH. 31.

2 Certification of the company\'s chief financial officer under section 302nd of the Sabans act

The Oakley Act of 2002. FILED HEREWITH. 32.

1 According to the certification of the company\'s chief executive on the 18 thS. C.

Section 1,350th passed under section 906th of the Sabans Act-

20549 Sentences: From 10 sentences:

The report is based on the month or month to be taken (d)

Commission File Number of the Securities Trading Act for the fiscal year 19-34 ended October 31, 2016 0-

27022________________________________________________OPTICAL cable the company

The exact name of the registrant specified in the articles of association)

________________________________________________ Virginia54-1237042(

State or other jurisdiction of company or organization)(I. R. S.

Employee Identification Number)

Va2419 5290 Roanoke CommScope Avenue (

Main executive office address)(Zip Code)(540)265-0690(

Registrant phone number, including area code)

Securities registered under section 12th (b)

The act: non-citizenship registered under section 12 (g)

Title of the act: title of each class name of each exchange registered common stock, global market without face value

Well-known experienced issuers as defined in Rule 405 of the Securities Act.

Yes. ☐No. ☒Indicate by check mark whether the registrant does not need to submit a report under Section 13 or section 15 (d)

Securities Trading Act of 1934.

Yes. ☐No. ☒Indicate by check mark whether the registrant (1)

All reports requested in Section 13 or 15 have been submitted (d)

Securities Trading Act of 1934 within the first 12 months (

Or a short period of time required for the registrant to submit such reports), and (2)

This filing requirement has been bound for the last 90 days. (1)Yes☒No☐(2)

Yes. ☒No. ☐Indicate by check mark whether the registrant has electronically submitted and posted on his company\'s website (if any), each Interactive Data File submitted and posted as required by regulation rule 05 05 --

12 months before T (

Or in such a short time that the registrant is required to submit and publish these documents).

Yes. ☒No. ☐If the declaration of arrears is disclosed under S-regulation 405th, please indicate by check markK (Section 229.

This Chapter 405)

As the registrant is aware, it is not included here and will not be included in the final proxy or information statement referenced in Part 3 of this form --

K or any amendments to this form 10K.

☐Indicate by check mark whether the registrant is a large accelerated file manager, a non-accelerated file manager

Or a smaller reporting company.

See the definition of \"large accelerated declarant\", \"accelerated declarant\" and \"small Reporting Company\" in rule 12b2 of the Act.

Largeacceleratedfiler☐Accelerated File☐Non

Speed up filer☐Smallerreporting company☒Indicate whether the registrant is a shell company by check mark (

Defined in Rule 12b-

Securities Trading Act 1934 2).

Yes. ☐No. ☒Total market value of the common stock of the registrant held by non-shareholders, without face value

Related Companies of registrants (

Does not recognize that any of the shares are not included in the determination of such value is a related company)

As of April 30, 2016, according to the NASDAQ Global Market Report of April 30, 2016, the last working day of the company in the most recent second quarter was $13,802,066.

As of December 13, 2016, the company had issued 7,081,034 shares of common stock.

Documents incorporated in the reference section of the company\'s annual report, filed as Exhibit 13.

Report on Form 10 1-

K incorporated by reference in the second part of this table 10

K report: \"Company Information\", \"Management Discussion and Analysis of financial status and results of operations\", \"notes to consolidated financial statements\", Report of Independent CPA firm.

\"In addition, part of the agency statement of the company\'s 2017 annual shareholders meeting is incorporated by reference in part 3 of this form 10.

K report: \"Election of Directors\", \"beneficial ownership of securities\", \"executive compensation\", \"remuneration of directors\", \"compliance with Section 16th (a)

Securities Trading Act of 1934, code of ethics, executive compensation, beneficial ownership of securities, information on equity compensation plans, \"certain relationships and related transactions\", \"independent registration accounting firm and Audit Committee

Approval of audits and permitted non-

Audit services for independent CPA firms.

Cable company Form 10-

KTABLE for CONTENTSPART iitem 1. Business. 3Item1A. Risk Factors. 8Item1B.

The employee\'s opinion was not resolved. 8Item2. Properties. 8Item3.

Legal proceedings. 9Item4.

Information disclosure of mine safety. 9PART IIItem5.

The market for the common equity of the registrant and related shareholder matters. 9Item6.

Select financial data. 10Item7.

Management Discussion and Analysis of Financial Position and operational results. 10Item7A.

Quantitative and qualitative disclosure of market risks. 10Item8.

Financial statements and supplementary information. 10Item9.

Changes and disagreements with accountants in accounting and financial disclosure. 10Item9A.

Control and procedures. 10Item9B.

Other information

Part 3 10.

Directors, executives and corporate governance. 11Item11.

Executive compensation. 12Item12.

Secured ownership of certain beneficial owners and management and related shareholder matters. 12Item13.

Certain relationship and related party transactions, the independence of directors. 12Item14.

Major accounting fees and services. Part ivitem15.

Detailed list of exhibits and financial statements.

13 signatures18part IItem1.

Business View optical cable was established in Virginia in 1983.

Our headquarters is located at 5290, 24019 Avenue, Roanoke, Virginia, and our telephone number is (540)265-0690.

Optical cable company and our wholly owned subsidiary Applied Optical Systems Company(“AOS”)

And center Solutions Co. , Ltd (

\"Center solution \")

With office, manufacturing and warehouse facilities in Roanoke, Virginia, close to Asheville, North Carolina and Dallas, Texas.

Optical Cable Company and its subsidiaries (

\"Company\" or \"OCC\"®\")

Is a leading manufacturer of optical fiber and copper data communication cabling and connectivity solutions, mainly for the enterprise market and a variety of harsh environments and professional markets (the non-Operator market)

Provide an integration suite of high quality products, run as a system solution, or seamlessly integrate with products from other providers.

OCC also produces and sells products in the wireless carrier market.

OCC\'s products include the use design of customized products from enterprise networks, data centers, residential and campus facilities to special applications and harsh environments (including military, industrial, mining, petrochemical, wireless operators and broadcast applications.

OCC products include fiber and copper, fiber and copper connectors, special fiber and copper connectors, fiber and copper jumpers, pre-

End-to-end fiber and copper cable assemblies, racks, cabinets, data communication enclosures, patch panels, panels, multiple

Media boxes, fiber optic reels and accessories and other cable and connection management accessories designed to meet the most demanding needs of the terminal

Provides a high degree of reliability and superior performance.

The OCC team is looking for first class service

Integrate communication solutions by bundling our products into systems that serve our customers and terminals

Users with integrated cabling and connectivity solutions

Suitable for personal data communication and application needs.

OCC®Is an international recognized pioneer in the design and production of fiber optic cables for the most demanding military applications, as well as fiber optic cables suitable for indoor and outdoor, based on the development of these basic technologies, create a wide range of products.

OCC®It is also an international recognized pioneering and innovative copper connection technology and design to meet the development of copper data communication standards in the industry.

OCC is registered and MIL-in accordance with its ISO 9001: 2008-STD-

790F certified factory is located in Roanoke, Virginia, and its enterprise connection products are mainly located in ISO 9001: 2008 registered factory near Asheville, North Carolina, with ISO 9001: 2008 registered and MIL-harsh environment and professional connectivity productsSTD-

790F certification facilities near Dallas, Texas.

OCC designs, develops and manufactures fiber optic cables for a wide range of enterprises, harsh environments and specialized markets and applications.

We call these products our fiber optic cable products.

OCC designs, develops and manufactures fiber and copper connectivity products for the enterprise market, including a wide range of enterprise and residential applications.

We call these products our enterprise connection products.

OCC is mainly used for military, harsh environments and other special applications, designing, developing and manufacturing a wide range of professional fiber optic connectors and connectivity products.

We call these products our harsh environment and professional connected products.

OCC sells our harsh environment and professional connectivity products in the name of optical cable company and OCC through AOS®With the efforts of our integrated OCC sales team.

Since February 1, 2016, the cable company has increased its ownership of Centric Solutions LLC (

\"Center solution \")to 100%.

Centric Solutions is a company founded in 2008 that provides turnkey cabling and connectivity Solutions for the data center market.

The central solution operates independently of the optical cable company and goes to the market;

However, in some cases, the central solution may provide the product that is offered by the OCC product.

The facility lease for Centric solution expired on November 30, 2015 but was not renewed.

OCC has moved the business of the Center solution to the OCC plant near Dallas, Texas.

Optical Cable Company®South River®Three blades in Nanhe™Advanced Modular Products™SMP Data Communication™Applied Optical System™Focus on solution™And the relevant logo is the trademark of the optical cable company.

Product socc®Is a leading manufacturer of optical fiber and copper data communication cabling and connectivity solutions, mainly for the enterprise market and a variety of harsh environments and professional markets (the non-Operator market)

Provide an integrated set of high-quality, guaranteed products that operate as a system solution or seamlessly integrate with products from other providers.

OCC also produces and sells a large number of products in the wireless carrier market.

OCC\'s products include designs for a variety of uses, from enterprise networks, data centers, residential and campus facilities, to customized products for harsh environments and special applications, including military, industrial, mining wireless operators and broadcast applications.

OCC products include fiber and copper, fiber and copper connectors, special fiber and copper connectors, fiber and copper jumpers, pre-

End-to-end fiber and copper cable assemblies, racks, cabinets, data communication housing, fiber and copper patch panels, panels, multiple

Media boxes, fiber optic reels and accessories and other cable and connection management accessories.

Our products are designed to meet the most demanding needs of the terminal

Provides a high degree of reliability and superior performance.

In the past two years, the OCC has obtained or received license notices for 17 optical fiber and copper connections and patents for innovative design of optical fiber cables.

Our fiber and copper cabling and connectivity products and solutions (

Mainly passive system, not active system)

Used to transmit data, video, radio frequency and voice communication mainly through short timeto moderate-distances.

Fiber optic cable products we design, manufacture, sell and sell a wide range of top products

The first layer of fiber optic cable that provides high bandwidth transmission of data, video and voice communication, mainly through short-to moderate-distances.

OCC is an international recognized pioneer in the design and production of fiber optic cables for the most demanding military applications, as well as fiber optic cables suitable for indoor and outdoor applications, based on the development of these basic technologies, created a wide range of products.

Our product line is diverse and versatile to meet the changing application needs of our customers in the market. Our tight-

The buffer fiber optic cable is mainly aimed at the enterprise market and various harsh environments and professional markets to meet various needs (the non-Operator market)

Including enterprise networks, data centers, residential and campus facilities, as well as the demand for harsh environments and professional markets such as military, industrial, mining, petrochemical and broadcasting applications, to a lesser extent.

OCC also produces and sells a large number of fiber optic cables and hybrid cables (

Fiber and copper)

Products in the wireless operator market.

Our patents.

Buffer fiber unit cable with high fiber-

Calculated and rugged in a compact and lightweight design.

We believe we provide the most comprehensive

Provide buffer optical cable products for our market.

We produce fiber optic cables specially installed, including a variety of hybrid cables (

Fiber and copper)

And cables with special fibers.

In some installations, we can provide additional protection for fiber optic cables.

We offer cables for underground or overhead installations.

For overhead installations, we provide several self-

Supports fiber optic cables, including air Messenger cables with self-function

Supporting construction.

We have a variety of fiber optic cables for flammable grades.