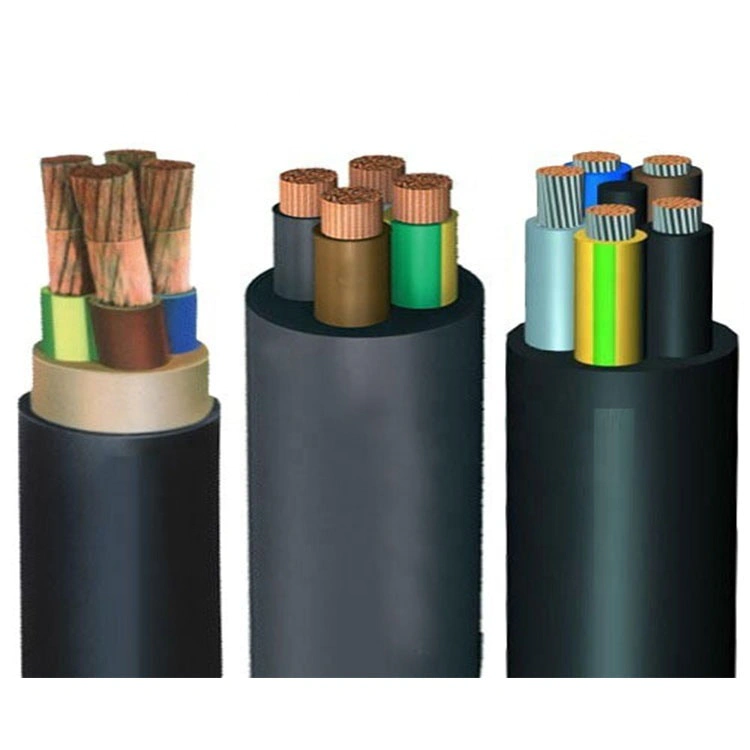

Premier Cable Manufacturer in China

Copper prices fell for the downstream cable industry

by:AAA

2020-04-03

(

Industry news]

Copper prices fell for the downstream heibaocjp P in cable industry, the London metal exchange (

LME)

Copper prices fell below $per ton milestone, for years since the first time, since then accelerated price drop;

Day, city dish in LME copper prices tumbled over %, and the years to the biggest drop, hit.

Dollars/tons, refresh years since a new low.

Copper prices 'avalanche' caused widespread market panic, but also the domestic market.

Month, Shanghai copper main contract low open low, opening soon hit a drop stop board, closed at yuan/ton, down yuan/ton.

Copper main contract, Shanghai opened sharply lower again, as below important mark yuan/ton.

For the future of copper, pessimistic attitude that many market participants.

Some analysts believe that the slump in copper prices, market panic, appear this kind of mood or will continue to spread, domestic copper prices are expected to fall to near yuan/ton.

According to the institute of consultancy British goods (

cru)

Forecast, copper future ~ months may also will continue to fall, refined copper imports in China will be put into tons, it will be the lowest level since years.

In addition, bloomberg strategist TanvirSandhu latest said, from the oil price, is looking for a new balanced %, copper prices may slump Sandhu also said that demand is weak, especially the poor Chinese demand, falling oil and yuan, a stronger dollar and put downward pressure on all of these factors to the copper.

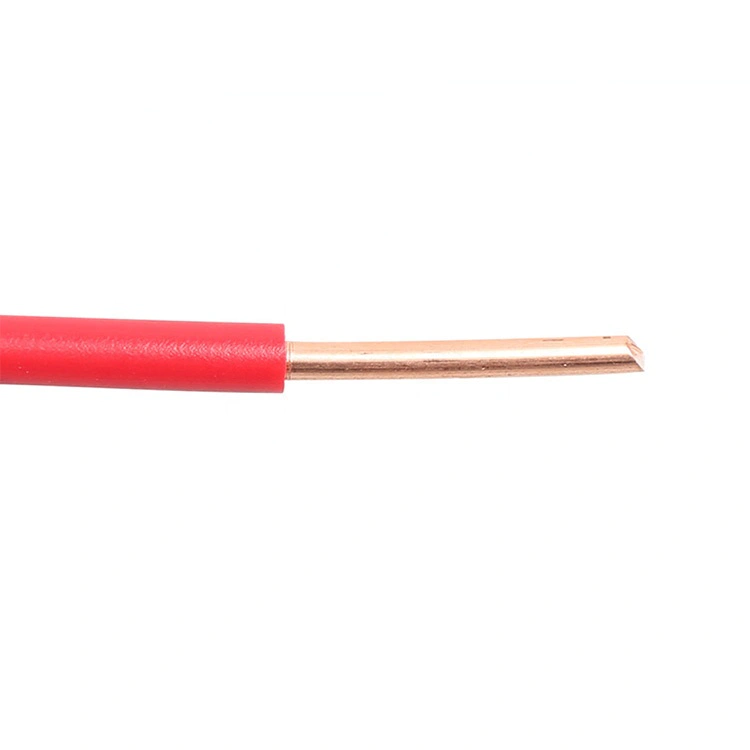

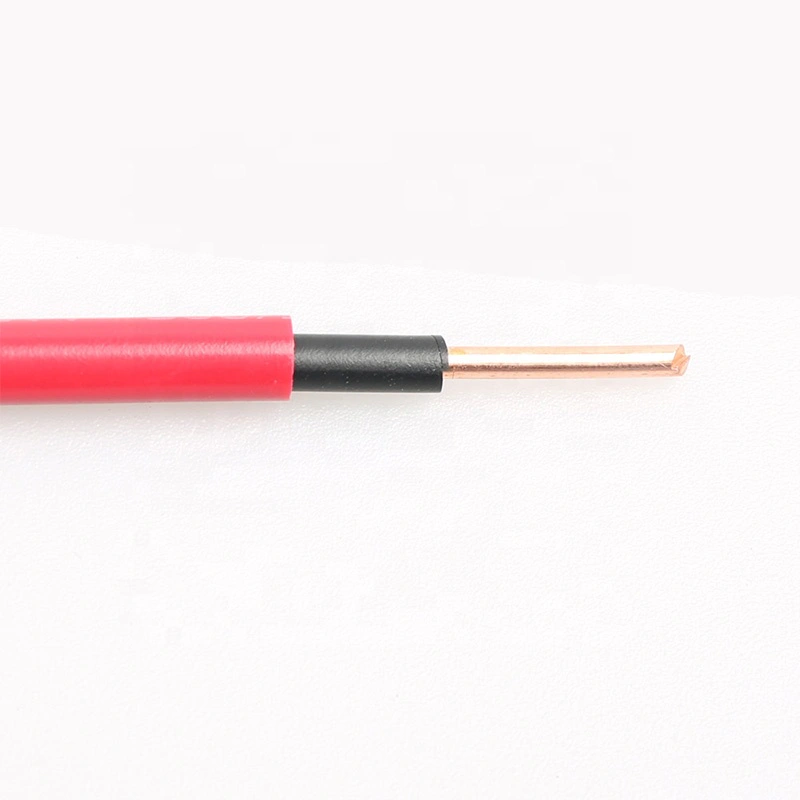

Copper prices fell for the downstream cable industry but is someone glad someone sorrow after all, while copper prices fell sharply, with copper for its downstream enterprises is real good, such as household appliances, cable industry, building materials, such as a copper as the main raw material of cable type of listed company, may in the raw material down bright eye.

With industry experts pointed out that copper accounts for more than % of cable cost of raw materials, basic cable order to silence the contract (

The contract price does not change along with raw material price fluctuation)

Is given priority to, for the most orders, execution in months, and years not to execute the contract only after the stock will greatly benefit from the price drop, are expected to % to cable companies because of falling copper stock orders release a net profit of at least a point.

Custom message